Advertisement|Remove ads.

Eli Lilly Stock Jumps Premarket On Dumping CVS Drug Plan After Wegovy Snub — Retail Calls It A Pushback Against PBM Power

- Lilly is reportedly shifting its 50,000 employees to Rightway, a fintech-driven pharmacy benefit manager, starting January 1.

- The move follows CVS Caremark’s decision to drop Lilly’s Zepbound from its preferred list in favor of Novo Nordisk’s Wegovy.

- Retail traders on Stocktwits described the split as a power shift in the growing clash between major drugmakers and PBMs.

Eli Lilly shares rose 0.4% in pre-market hours on Wednesday after a report said the company will move its employee pharmacy benefits away from CVS Health’s Caremark unit, following a dispute over coverage of its blockbuster weight-loss drug Zepbound.

Lilly to Shift Employee Drug Coverage

Eli Lilly is reportedly replacing CVS Health Corp.’s drug-benefit plan for its roughly 50,000 employees with a new arrangement managed by Rightway, a privately held pharmacy-benefit manager, Bloomberg reported.

The switch will take effect on January 1, automatically enrolling Lilly workers covered under the company’s health plan into the new pharmacy benefit manager (PBM). The move comes after CVS Caremark dropped Lilly’s Zepbound from its preferred-drug list earlier this year in favor of Novo Nordisk’s Wegovy, a rival weight-loss medication.

Cost Dispute Behind The Split

CVS Health previously said its decision to prioritize Wegovy was part of an effort to cut costs for plan sponsors by negotiating the two drugmakers against each other. Plans that include both Wegovy and Zepbound remain available, but at a higher cost, according to the company.

Lilly’s reported shift follows concerns that CVS’s coverage changes could hurt Zepbound sales by limiting patient access through employer health plans.

Rightway To Manage New Benefits

Rightway, the fintech-driven PBM chosen by Lilly, confirmed its new partnership, saying it was “excited to enable innovative, best-in-class benefits” for the drugmaker’s employees and retirees.

Lilly CEO Dave Ricks also referenced the change in a recent podcast, saying the company had moved from a “traditional” PBM to a newer, technology-focused provider.

GLP-1 Rivalry Intensifies

The decision adds a new chapter to the ongoing competition between Lilly and Novo Nordisk, whose GLP-1-based drugs have transformed the obesity-treatment market.

CVS’ partnership with Novo Nordisk also allows it to sell Wegovy directly to cash-paying customers for about $499 per month at its pharmacies.

Stocktwits Traders See Lilly’s Exit As Blow To CVS’s PBM Dominance

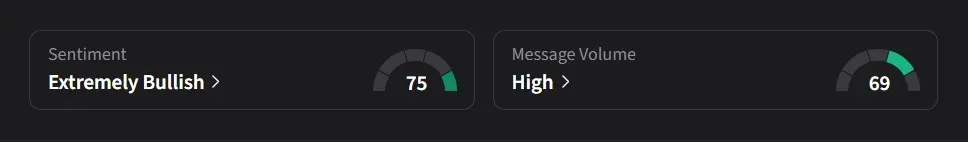

On Stocktwits, retail sentiment for Eli Lilly was ‘extremely bullish’ amid ‘high’ message volume.

One user said CVS appeared to be under pressure after Eli Lilly ended its employee drug plan with the pharmacy chain. The user viewed the move as a strategic response to CVS Caremark’s earlier decision to exclude Lilly’s weight-loss drug from coverage, describing it as part of a broader pushback by major drugmakers against pharmacy-benefit managers and a reputational setback for CVS.

Eli Lilly’s stock has risen 29% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)