Advertisement|Remove ads.

Equifax Stock Dives After Q4 Earnings, 2025 Guidance Miss Estimates: Retail Cheers Dividend Payment For 100-Plus Consecutive Years

Shares of data analytics firm Equifax Inc (EFX) fell nearly 7% on Thursday, heading toward their worst single-day session since April 18, 2024, after the company’s 2025 guidance fell short of Wall Street estimates.

For 2025, Equifax projected an adjusted earnings per share (EPS) of $7.45 on revenue of $5.95 billion. According to FinChat data, Wall Street expects EPS of $9.07 on revenue of $6.33 billion.

The company’s board of directors declared a quarterly dividend of $0.39 per share, payable on March 14, 2025, to shareholders of record as of the close of business on Feb. 21, 2025. Notably, Equifax has paid cash dividends for more than 100 consecutive years.

For the fourth quarter (Q4) of 2024, Equifax reported a 7% year-over-year (YoY) rise in revenue to $1.42 billion compared to an analyst estimate of $1.44 billion. Net income rose 31% YoY to $174 million.

Adjusted EPS came in at $2.12 compared to the estimated $2.11.

Segment-wise, Workforce Solutions revenue grew 7% YoY to $598.1 million, while USIS revenue rose 10% YoY to $472.5 million. International revenue grew 3% to $348.8 million during the quarter.

CEO Mark Begor said the company’s free cash flow rose 58% in 2024 to $813 million while its balance sheet strengthened, positioning the firm to grow its dividend and return cash to shareholders through share repurchases in 2025.

“With our North American Consumer Cloud migrations substantially completed, we are leveraging our new Cloud capabilities to accelerate new product solutions leveraging our differentiated data assets and investing in new products, data, analytics, and EFX.AI capabilities, which are expected to drive growth in 2025 and beyond,” he said.

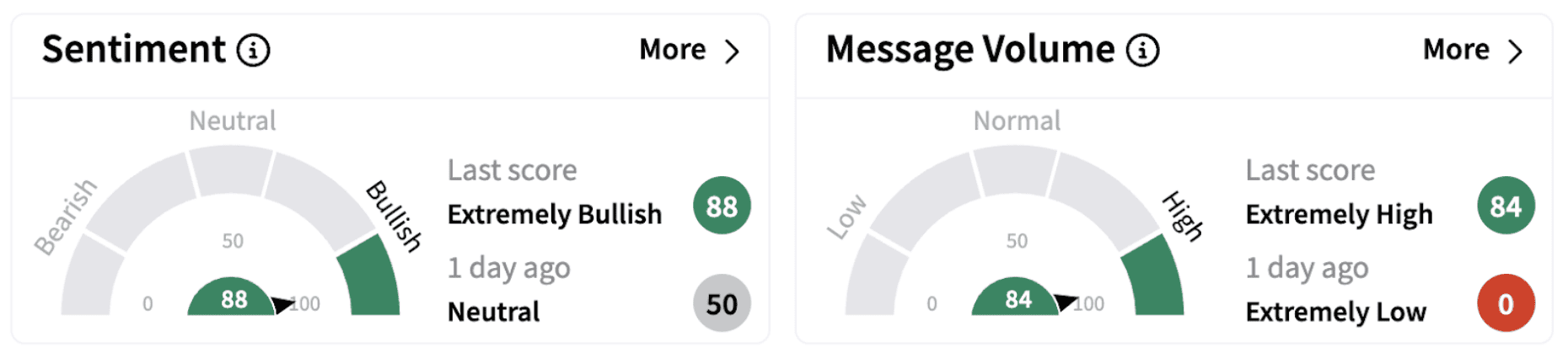

On Stocktwits, retail sentiment flipped into the ‘extremely bullish’ territory (88/100) from ‘neutral’ a day ago. The move was accompanied by significant retail chatter.

One user believes the current level could be a great entry point.

EFX stock gained just over 0.2% in 2025 and has been up over 3% in the past year.

Also See: Fastenal Reports Marginal Rise In January Sales: Retail’s Not Impressed

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246553876_jpg_6597db9167.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235797357_jpg_2c6f3265ce.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_o_leary_OG_jpg_2789641a97.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_lights_original_jpg_db38183cfe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)