Advertisement|Remove ads.

ETWO Stock Tanks 19% After Q2 Revenue Miss: But Retail Sentiment Inches Higher

Shares of SaaS-based supply chain software-maker E2Open Parent Holdings Inc (ETWO) plunged nearly 19% on Thursday after the firm reported a 4% decline in second-quarter revenue and revised its fiscal 2025 guidance.

Adjusted earnings per share (EPS) for the second quarter (Q2) came in at $0.05, beating analyst estimates of $0.02 Revenue came in at $152.2 million, falling short of an estimate of $154.8 million while adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) fell 22% year-over-year (YoY) to $54.9 million.

CEO Andrew Appel said e2open continued to execute its comprehensive, client-focused plan to re-position the company for strong organic growth, and also made important progress in key areas.

Appel added that the firm saw increased quarterly subscription bookings both year-over-year and compared to the prior quarter, but saw delays in closing “certain large, complex deals due to extended client decision timelines.”

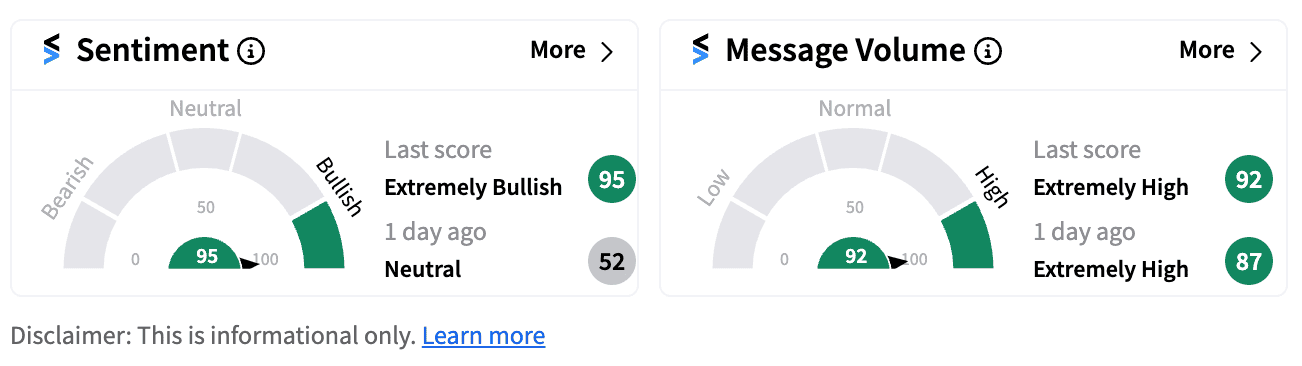

Despite the slide in stock price, retail sentiment jumped into the ‘extremely bullish’ territory (95/100) from ‘neutral’ (52/100) a day before. The move was accompanied by ‘extremely high’ message volume.

Meanwhile, some Stocktwits users remain optimistic about the firm’s prospects, attributing the decline in sales to slow software transitions at companies.

h

The company also lowered its guidance for fiscal 2025 revenue to the range of $526 million to $532 million, reflecting a negative 1.5% organic growth rate at the mid-point. Adjusted EBITDA for fiscal 2025 is expected to come in at the low end of the previously provided range of $215 million to $225 million.

For the third quarter, the firm expects revenue to be in the range of $130 million to $133 million, reflecting a negative 1% organic growth rate at the mid-point.

E2Open stock is down 25% year-to-date.

Also See: Celsius Holdings Stock Keeps Retail Energized With Pre-Market Jump

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1061406346_jpg_1af8a0eae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_again_dcd66ed9d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_william_li_nio_jpg_c26eaad557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243094578_jpg_0f996b2394.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)