Advertisement|Remove ads.

Farmland Partners Stock Gains After The Bell On Q4 Revenue Beat: But Retail’s Unfazed

Farmland Partners Inc. (FPI) stock gained 1% in aftermarket trade on Wednesday after the company’s fourth-quarter revenue beat Wall Street’s estimates.

The agriculture-focused real estate firm reported operating revenue of $21.5 million for the fourth quarter. Analysts, on average, expected the company to post $20.3 million in revenue.

Its net income for the quarter soared to $57.6 million, compared to $16.5 million in the year-ago quarter, aided by asset sales.

The company’s adjusted funds from operations (AFFO), a metric used to gauge the profitability of real estate firms, stood at $0.19 per share, topping the Wall Street estimate of $0.17 per share.

However, its rental income during the quarter declined marginally to $17.6 million from $18.1 million in the year-ago quarter.

As of Dec. 31, the company's portfolio included approximately 93,500 acres of owned farmland and 48,300 acres of managed farmland.

Farmland projected 2025 revenue between $46.5 million and $48.1 million, compared with the analysts’ estimated $47.24 million.

The company projected an AFFO/share of $0.30 in the fourth quarter. Wall Street expects the company to post $0.23.

However, it expects fixed farm rent to decline to between $20.5 million and $21 million, compared with $32.2 million in 2024.

Farmland agreed to sell a portfolio of 46 farms, comprising 41,554 acres of farmland, to Farmland Reserve Inc. in October for $289 million.

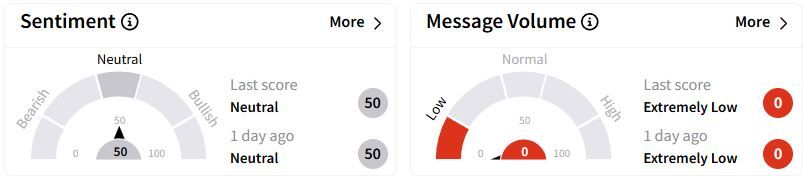

Retail sentiment on Stocktwits remained in the ‘neutral’ (50/100) territory, while retail chatter was ‘extremely low.’

Over the past year, Farmland Partners stock has gained marginally.

Also See: NerdWallet Stock Gains After The Closing Bell On Q4 Revenue Beat: Retail’s Elated

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235745938_jpg_f29c2bc96f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244949316_jpg_a5294e121e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_celsiusholdings_resized_jpg_5617397fa8.webp)