Advertisement|Remove ads.

Fed’s Mary Daly Reportedly Says Policy Needs To Be Restrictive Until There’s Progress On Inflation

San Francisco Federal Reserve Bank President Mary Daly reportedly said on Tuesday that the central bank should keep its policy restrictive until there’s an improvement in inflation.

"Policy needs to remain restrictive until ... I see that we are really continuing to make progress on inflation," Daly said at a community banking conference hosted by the American Bankers Association in Phoenix, Arizona, according to a Reuters report.

“There’s, in my mind, no reason to be discouraged about the progress on inflation today,” Daly said, according to Bloomberg. “It just is going to take longer than anyone wants.”

Consumer price index (CPI) rose 0.5% on a seasonally adjusted basis in January, while the annual inflation rate rose 3%, according to the Bureau of Labor Statistics. According to a CNBC report, this compared with a Dow Jones estimate of 0.3% and 2.9%, respectively.

Core CPI, which excludes food and energy prices, rose 0.4% in January and increased 3.3% annually, versus estimates for 0.3% and 3.1%.

Atlanta Federal Reserve President Raphael Bostic reportedly said on Wednesday that it is unclear when the central bank can reduce interest rates again in the wake of uncertainty around the inflation trajectory and the scope of possible changes to tariffs and other policies from the Trump administration.

"It's going to take a while to just figure out what is going on," Bostic said in a presentation to business executives in Atlanta.

Although traders initially pared their expectations of a rate cut in July and shifted their focus to October, the latest CME FedWatch tool data shows the market is gradually building expectations of a rate reduction in July.

Last week, Bank of America CEO Brian Moynihan reportedly said the Federal Reserve will unlikely cut rates this year as consumer spending remains strong.

“Our research team has taken all rate cuts off the table because they thought that the dynamics of the potential inflationary effect would cause the Fed to hold back,” he said.

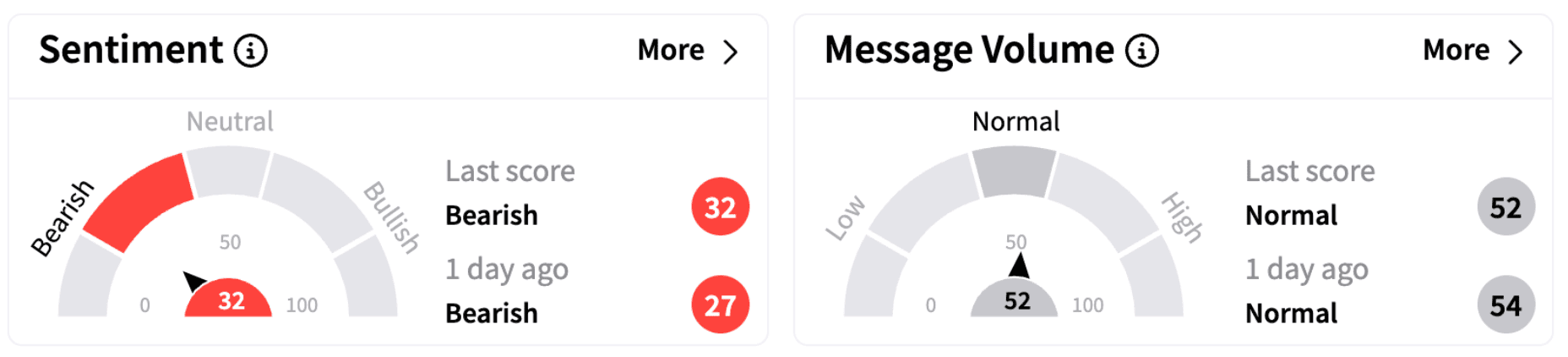

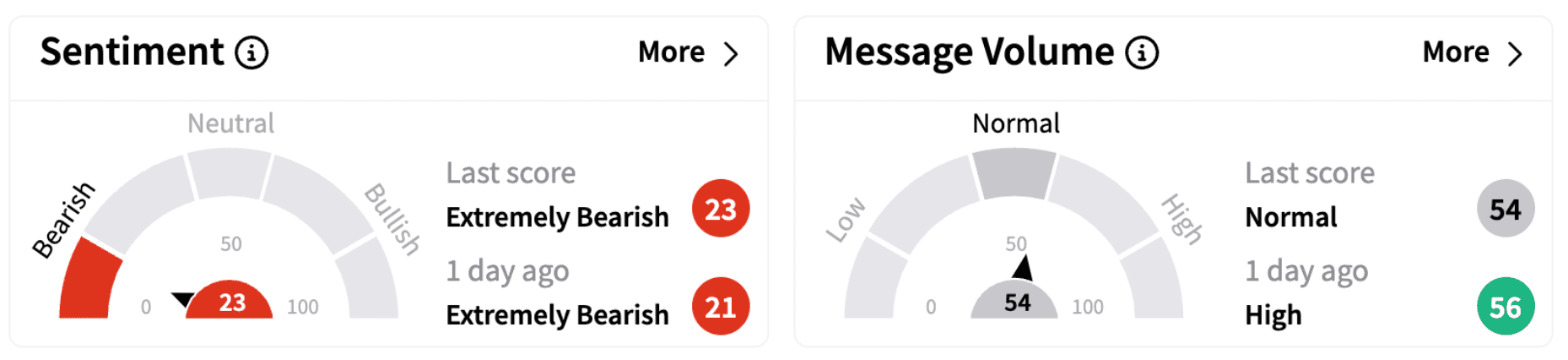

On Tuesday, the SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust, Series 1 (QQQ) traded marginally in the green. Retail sentiment on Stocktwits toward these ETFs remained in the ‘bearish’ territory.

Investors will also monitor any developments in President Donald Trump’s tariff policies, which are expected to significantly impact the inflation trajectory in the coming months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)