Advertisement|Remove ads.

First Solar Q4 Earnings Expected To Surge, Stock Bags Mizuho Upgrade On ‘Materially Improved’ Outlook: Retail’s Bullish

Shares of First Solar Inc. (FSLR) will be in focus on Tuesday. According to Wall Street expectations, the company’s fourth-quarter earnings and revenue are expected to surge year over year (YoY).

Data from Stocktwits shows that First Solar could post earnings per share (EPS) of $4.63 during Q4, up more than 42% from $3.25 in the same period last year.

First Solar is expected to report revenue of $1.48 billion during the quarter, rising from $1.16 billion during the same period last year.

The company is an Arizona-based manufacturer of solar panels and a provider of utility-scale photovoltaic power plants.

The company and the rest of the solar power industry face uncertainty amid President Donald Trump’s policy on tax credits for this sector.

It is scheduled to report its Q4 results on Tuesday, during after-market hours.

However, in an earlier bittersweet outlook for First Solar, Mizuho analysts have suggested that potential tariffs under a Trump administration could help cushion the impact of the tax credit program’s expiration in 2026, according to The Fly.

Citing a “materially improved” sales outlook post-2026, the brokerage upgraded the First Solar stock to ‘Outperform’ from ‘Neutral’ while hiking the price target to $259 from $218. This implies an upside of more than 69% from current levels.

Data from FinChat shows the average price target of 41 brokerage recommendations for First Solar is $266.76, implying an upside of over 74% from current levels.

Of these, there are 22 ‘Buy,’ and 13 ‘Outperform’ ratings, five recommendations of ‘Hold,’ and one brokerage has ‘No Opinion.’

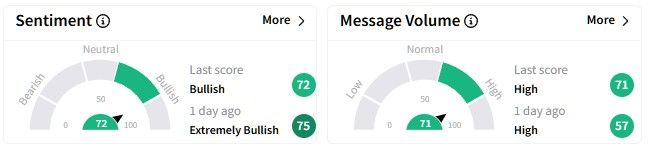

Retail sentiment on Stocktwits around the First Solar stock was upbeat at the time of writing, hovering in the ‘bullish’ (72/100) territory. Message volume soared, too.

First Solar’s shares have been on a downtrend over the past six months, losing more than 34% of their value.

However, the stock has delivered positive returns over the past year, with gains of 5.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)