Advertisement|Remove ads.

Fitell Joins Corporate Crypto Wave With $100M Solana Treasury Plan

Fitell (FTL) on Tuesday announced plans to launch what it called Australia’s first Solana (SOL)-based digital asset treasury, backed by a $100 million financing facility.

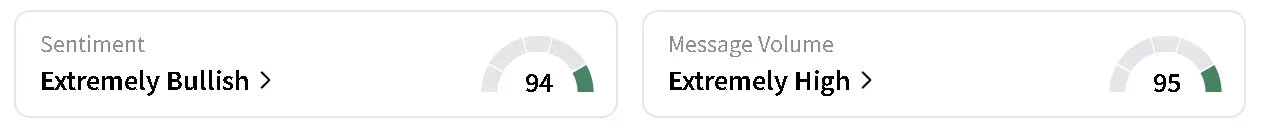

Fitell’s stock spiked to an intra-day high of $15.79 before pulling back to around $7 at the time of writing. Trading was highly volatile, triggering multiple halts throughout the session, according to Nasdaq Trader. Retail sentiment around the company on Stocktwits surged to ‘extremely bullish’ from ‘bullish’ territory, and chatter jumped to ‘extremely high’ from ‘high’ levels over the past day.

The company stated that the initiative will utilize decentralized finance (DeFi) strategies to generate yield on the company's funds, effectively transforming the company’s struggling hardware business into a crypto-treasury play. Fitell has appointed DeFi veterans David Swaney and Cailen Sullivan as advisers to design the roadmap, including risk-management frameworks and yield-generation strategies beyond traditional staking models.

The announcement so far provides few operational details or a clear connection to Fitell’s core fitness business. However, the company has scheduled a live session at 4:00 p.m. ET on Tuesday to share additional information and address investor questions. With revenue still minimal and the stock trading at multi-year highs, investors will be watching closely to see whether the Solana initiative reflects a meaningful balance-sheet strategy or is largely a publicity-driven move.

Fitell’s shift toward a Solana-based digital asset treasury (DAT) mirrors a broader trend among public companies. Firms such as Upexi (UPXI), SOL Strategies (STKE), and Forward Industries (FORD) have all announced similar pivots this year. Upexi currently has the largest holdings of Solana, amounting to more than two million SOL.

Solana’s price slipped 1.3% over the past 24 hours but still sits more than 6% higher over the past month. Retail sentiment on Stocktwits remains in ‘neutral’ territory, while chatter has dropped from ‘normal’ to ‘low’ levels over the past day.

Meanwhile, Fitell also completed a 1-for-16 share consolidation of its ordinary stock that raised the par value from $0.0001 to $0.0016.

Read also: Morgan Stanley Stock Hits Record High On Plans To Offer Crypto Trading To E*Trade Clients: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_CEO_OG_jpg_e773f9395c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_543225021_jpg_d5737b0d33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2173218234_fotor_2025021091559_3d9884379a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Big_Bear_jpg_8fce0f24aa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1242030871_jpg_12741b089b.webp)