Advertisement|Remove ads.

Ford Stock Edges Up After Report Of F-150 Lightning Being Scrapped — Retail Hopes Fortunes Improve Amid EV Slowdown

- Ford is reportedly considering ending production of its F-150 Lightning electric pickup after weak demand and $13 billion in EV losses since 2023.

- The potential move marks a broader retreat from large, costly electric trucks as automakers like GM, Stellantis, and Rivian scale back EV plans.

- Retail investors on Stocktwits viewed the news as positive for profitability, arguing that fewer money-losing EVs could improve Ford’s margins.

Ford Motor Co. shares inched higher on Thursday after reports said executives are in active discussions about ending production of the F-150 Lightning, the electric version of its top-selling pickup. The move, still under review, would make the Lightning the first major casualty among U.S. full-size electric trucks.

The model, once described as a “modern Model T,” has missed sales targets as mainstream truck buyers have favored gas-powered versions. Ford has logged about $13 billion in EV losses since 2023, underscoring the strain of high development costs and weak demand, according to a report by The Wall Street Journal.

Dealers Report Weak Demand For Big EVs

“The demand is just not there,” said Adam Kraushaar, who owns Lester Glenn Auto Group in New Jersey and sells Ford, GMC, and Chevy vehicles. He added that his dealerships rarely order the Lightning because “we don’t sell them.”

Ford’s internal review comes as industrywide EV demand cools following the expiration of federal tax credits and the fading of incentives. Large electric pickups and SUVs are among the hardest hit.

Detroit Automakers Scale Back EV Ambitions

Stellantis this year canceled plans for an electric Ram 1500, while General Motors executives have discussed trimming their EV truck lineup. Tesla’s Cybertruck sales have fallen, and Rivian has cut jobs to preserve cash.

The shift aligns with CEO Jim Farley’s view that EVs suit commuting and short-range driving, while larger trucks will continue to rely on hybrid or gasoline powertrains.

Production Pause Adds To Uncertainty

Ford stopped production of the Lightning last month due to a shortage of aluminum. The company is now considering whether to keep the Rouge Electric Vehicle Center shuttered as it turns to smaller, less expensive EVs. The company has reportedly said it will restart production “at the right time.”

In October, Ford’s U.S. EV sales fell 24% year on year. Dealers sold about 66,000 gas-powered F-Series pickups versus just 1,500 Lightnings, the lowest volume of any model in the line.

Stocktwits Traders Cheer Move To Cut EV Losses

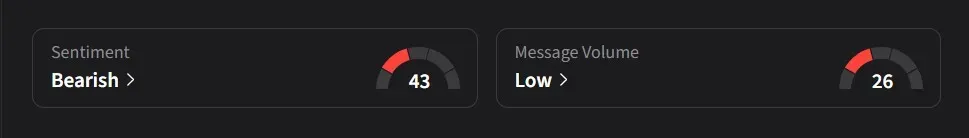

On Stocktwits, retail sentiment for Ford was ‘bearish’ amid ‘low’ message volume.

One user said the company’s EV division incurs several thousand dollars in losses per vehicle produced, arguing that reducing production would help limit those losses and improve profitability.

Another user called the EV market “a total value trap,” urging Ford and General Motors to “scrap it all and build a better internal combustion engine” before the companies are “driven into the ground.”

A third user said that high prices above $50,000 and range concerns have deterred buyers, which is part of a broader cooling in demand for large, expensive electric trucks.

A fourth user compared the F-150 Lightning to “the new Edsel,” a reference to Ford’s infamous 1950s flop that became a symbol of poor product-market fit and overhyped innovation.

Ford’s stock has risen 42% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)