Advertisement|Remove ads.

Freshworks Analysts Boost Price Targets After Solid Q4 Results, But Retail Turns Cautious

Freshworks, Inc. (FRSH) stock erased early losses and turned higher in afternoon trading on Wednesday as analysts bumped up price targets in reaction to the software-as-a-service (SaaS) products provider's fiscal year 2024 fourth-quarter beat.

The San Mateo, California-based company reported fourth-quarter adjusted earnings per share (EPS) of $0.14 compared to the $0.08 earned a year ago and the consensus estimate of $0.10.

On a reported basis, the company incurred a loss of $0.07, narrower than the year-ago loss of $0.09.

Revenue climbed 22% year over year (YoY) to $194.6 million, compared to the consensus estimate of $189.4 million.

The top- and bottom-line results also exceeded the guidance issued in early November.

CEO Dennis Woodside said, “Freshworks outperformed its previously provided estimates again in Q4 across all our key metrics, delivering another strong quarter with revenue growing 22% year over year to $194.6 million, operating cash flow margin of 21%, and an adjusted free cash flow margin of 21%.”

Among key user metrics, the number of customers contributing more than $5,000 in annual recurring revenue (ARR) climbed 11%, slower than the 14% growth in the third quarter. The net dollar retention rate was 103% compared to the preceding quarter’s 107%.

Freshworks expects first-quarter adjusted EPS of $0.12 to $0.14 and revenue of $190 million to $193 million, versus the consensus estimate of $0.13 and $191.98 million, according to Yahoo Finance.

The company guided fiscal year adjusted EPS to $0.52-$0.54 and revenue to $809 million-$821 million. The corresponding consensus estimates are at $0.52 and $816.06 million.

Following the fourth-quarter print, Freshworks stock received several price target increases, with the latest numbers ranging from $18 to $25, TheFly reported.

BofA, despite nudging up the price target for the stock, remained at ‘Neutral,’ citing concerns that the 2025 guidance assumed back-half revenue deceleration.

Needham analyst Scott Berg noted forex serving as a headwind to revenue and metrics, driving lower large customer additions than recently seen. However, he noted that total customer net additions hit a four-year high as free-to-paid conversions ramped in the fourth quarter, driving new monetization.

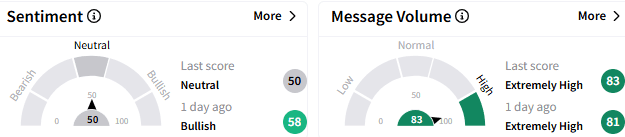

On Stocktwits, sentiment toward Freshworks stock turned ‘neutral’ (50/100) from ‘bullish’ a day ago but the message volume stayed at ‘increasingly high’ levels.

A retail watcher said the quarterly beat had already been priced in.

Another user, however, could not make sense of the negative stock reaction, despite upbeat results.

The stock traded up 0.73% to $17.99, having gained 10.5% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)