Advertisement|Remove ads.

Gap Shares Surge After-Market As Q4 Earnings Smash Wall Street Estimates: Retail’s Extremely Bullish

Shares of Gap Inc. (GAP) rose 19% in after-hours trading on Thursday following the company’s fiscal fourth quarter earnings beat, lifting retail sentiment.

Gap, which owns such clothing brands as Old Navy, Banana Republic, and Athleta, posted earnings per share of $0.54, above the estimated $0.38 quoted by Wall Street analysts.

Revenue came in at $4.15 billion, surpassing estimates of $4.07 billion, according to Stocktwits data.

Comparable sales were up 3% year-over-year, the company said.

"For the full year 2024, Gap Inc. delivered positive comps in all four quarters, achieved one of the highest gross margins in the last 20 years and meaningfully increased operating margin versus the prior year,” said GAP’s president and CEO, Richard Dickson.

Dickson said the results are underpinned by the momentum the company is seeing in its operational execution, our culture, and the reinvigoration of its brands “as they climb in the cultural conversation.”

Gap warned its outlook includes the current macroeconomic environment and related headwinds to consumer spending, including inflationary pressures, tariffs, supply chain disruptions, and foreign currency volatility.

For 2025, it expects net sales to see 1% to 2% growth from $15.1 billion in 2024. That compares to the consensus estimates of $15.38 billion.

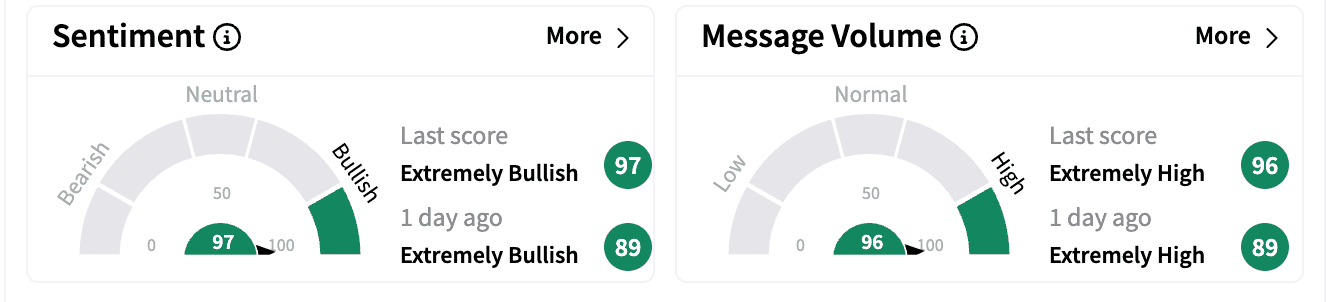

Sentiment on Stocktwits rose higher in the ‘extremely bullish’ zone. Message volume inched up in the ‘extremely high’ territory.

One bullish commenter praised the company’s diversified supply chain and less risk from tariffs.

Gap stock is down 17% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)