Advertisement|Remove ads.

GE Aerospace Shares Slip Despite Earnings Win and Upbeat Outlook: Retail Sentiment Still Bullish

Shares of GE Electric Company ($GE), doing business as GE Aerospace, were down as much as 4% before markets opened on Tuesday despite the company raising its full-year profit forecast and beating third-quarter earnings estimates.

The aircraft engine supplier posted revenue of $9.84 billion, beating Wall Street expectations of $9.02 billion. Its earnings per share (EPS) came in at $1.15, beating estimates of $1.13.

“The GE Aerospace team delivered strong results with demand driving orders up 28%. We grew earnings 25% and produced substantial free cash flow, both largely driven by services,” stated GE Aerospace CEO Lawrence Culp.

The company has raised its full-year guidance, expecting operating profits of $6.7 billion to $6.9 billion, up from the prior range of $6.5 billion to $6.8 billion. Earnings per share are expected at $4.20 to $4.35, up from a previous range of $3.95 to $4.20.

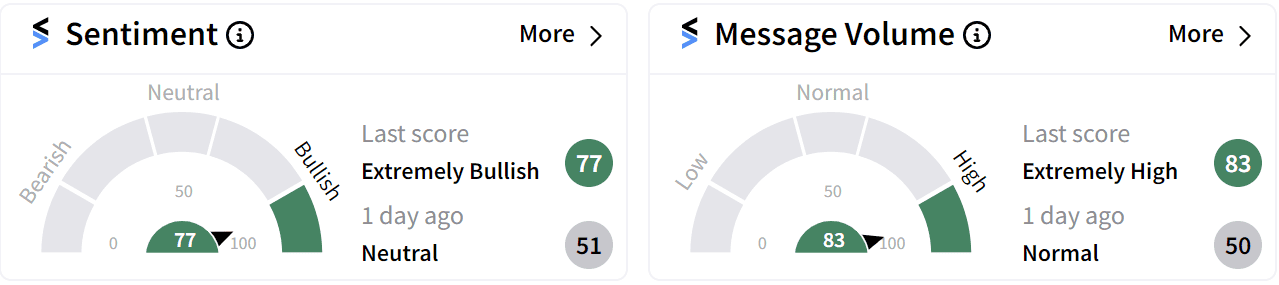

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (77/100) territory marking a considerable uptick from ‘neutral’ just a day ago ahead of markets opening on Tuesday.

Culp also highlighted that while the ongoing strike at Boeing ($BA), one of its key customers, hasn’t impacted GE Aero yet, there are chances that if it extends for longer, it could create problems for aerospace suppliers.

GE Aero’s stock has gained 47% so far in 2024 and is up 73% in the last 12 months.

For updates and corrections email newsroom@stocktwits.com

Read More: General Motors Stock Climbs After Earnings Beat, Raised Guidance: Retail Sentiment Still Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)