Advertisement|Remove ads.

Genius Group Rockets 250% In 2 Months On Bitcoin Bet But Retail Hits The Brakes

Genius Group (GNS) shares have soared nearly 250% in the last two months, driven by its efforts to steadily increase the purchase of Bitcoin for its BTC Treasury after resuming it in May. However, retail investors remain on the fence, with users having turned ‘bearish’ on Stocktwits.

Genius Group shares were down nearly 6% during midday trading after having risen 87% year-to-date. Shares of the educational group currently trade at $1.29 compared to $0.38 two months ago.

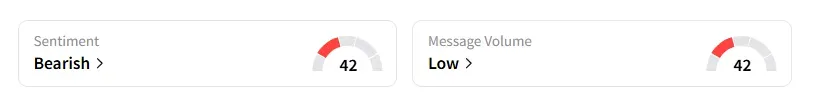

Over the last 24 hours, retail user messages on Stocktwits have increased by 103%. Retail sentiment on the stock dipped to ‘bearish’ from ‘bullish’ a week ago, with chatter at ‘low’ levels, according to data by Stocktwits.

On Monday, Genius Group announced that it had purchased 20 Bitcoin on July 18, increasing its Bitcoin Treasury to 200 Bitcoin at an average price of $106,812 per Bitcoin. It has achieved a 186% BTC yield since May 22.

This is part of the company’s goal to build its Treasury to 1,000 Bitcoin before the end of 2025, a target Genius Group first announced in November 2024.

In the past two months, alongside efforts to build its Bitcoin Treasury, the company saw its shares propelled by CEO and Founder Roger Hamilton's purchase of 650,000 Genius Group shares in June, which increased his stake by 10%.

In July, the company bought back one million shares of its stock on the open market at an average price of $1.30 per share after its shareholders voted 98.8% in favor of a proposed share buyback mandate, which authorized the board to buy back up to 20% of the company’s stock.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Coca-Cola, Philip Morris, Cal-Maine Earnings In Focus, Retail Investors Fizz Up

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)