Advertisement|Remove ads.

Getty Images Retail Traders Feel Upbeat Ahead Of Q4 Earnings: Here’s What Wall Street Expects

Getty Images Holdings, Inc. (GETY) stock is in the spotlight as the creative and editorial visual content solutions provider is scheduled to report its quarterly results after the market closes on Monday.

The Finchat-compiled consensus estimates call for the company to report earnings per share (EPS) of $0.06 and revenue of $246.31 million.

This compares to the year-ago’s $$0.06 and $246.31 million, respectively, and the previous quarter’s $0.04 and $240.5 million.

The year-over-year (YoY) third-quarter revenue growth was 4.9%.

Getty Images reported an adjusted earnings before interest, taxes and depreciation (EBITDA) of $72.2 million and $80.6 million, respectively, in the year-ago quarter and the preceding quarter.

Among performance metrics, Getty Images’ last-twelve-month (LTM) total purchasing customers fell 12.9% YoY to 719,000 in the third quarter. The LTM total active annual subscribers, however, jumped 47.7% to 298,000 and the LTM paid download volume edged down 0.7% to 94,000.

In the third quarter, the LTM annual subscriber revenue retention rate fell 230 basis points to 92.2%.

Getty Images’ guidance issued in early November called for 2024 revenue of $934 million to $943 million, marking 1.9%-2.9% growth. It expects a full-year adjusted EBITDA of $292 million to $294 million.

The company recently renewed its multi-year partnership with the Union of European Football Association (UEFA) to serve as the latter’s official appointed photographic agency. It also signed a multi-year photography partnership with the National Women’s Soccer League.

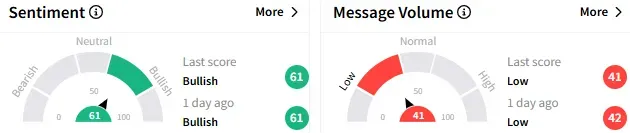

The retail mood toward Getty Images stock remained ‘bullish’ (61/100) on Stocktwits, with the message volume, however, staying ‘low.’

A bullish watcher said he would recommend buying and holding the stock as they are optimistic about the prospect and the pricing power once the Shutterstock deal close.

Getty Images and Shutterstock, Inc. ($SSTK) announced in early January that they would combine in a deal valued at $3.7 billion.

Getty Images’ stock ended Friday’s session up 2% at $2.04, although it has lost over 5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Apple Stock Is Down 15% In 2025, But One Analyst Warns Against Selling — Retail Isn’t Convinced

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)