Advertisement. Remove ads.

Gevo Stock Soars 18% to Two-Year High Following $1.46B DOE Commitment – Retail Ecstatic

Shares of Gevo Inc. (GEVO) surged over 18% on Thursday, reaching a two-year high of $2.69, after the company announced it received a conditional commitment from the U.S. Department of Energy (DOE).

Gevo develops bio-based alternatives to petroleum-based products. The conditional loan guarantee of $1.46 billion from the DOE will go towards constructing Gevo’s Net-Zero 1 project (NZ1) in South Dakota.

The NZ1 facility is designed to produce approximately 60 million gallons of sustainable aviation fuel (SAF)

Gevo's NZ1 facility is set to produce about 60 million gallons of sustainable aviation fuel (SAF), 1.3 billion pounds of protein and animal feed, and 30 million pounds of corn oil each year. The facility aims to create SAF with a net-zero carbon footprint over its entire lifecycle.

“This marks a watershed moment for the Net-Zero 1 project and a critical step forward in Gevo’s mission to transform the aviation industry by providing a scalable, sustainable, and economical renewable-carbon-based jet fuel—SAF,” said Gevo CEO Patrick Gruber.

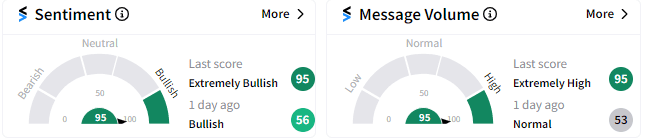

Retail sentiment on Stocktwits inched up into the ‘extremely bullish’ (95/100) from ‘bullish’ a day ago.

Gevo’s stock has gained 17.5% so far in 2024 with most of the gains coming from Thursday’s surge.

For updates and corrections email newsroom@stocktwits.com.

Read more: TSMC Stock Surges Pre-Market, Lifting Apple and Nvidia After Quarterly Profit Jump – Retail Rejoices

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_ny_motor_show_resized_jpg_2372b47562.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_lights_original_jpg_db38183cfe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_jpg_6c4cc95d17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/11/advertising.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/10/csr-corporate-social-responsibility-2024-10-528edecbe166c0116ce7a40a97faa6ff.jpg)