Advertisement|Remove ads.

Gilead Sciences Signs $750M Deal For Cancer Drug With Kymera Therapeutics, Predicts Hit To Its Annual Profit

Gilead Sciences, Inc. (GILD) said on Wednesday that it entered into an exclusive option and license agreement with biotech company Kymera Therapeutics, Inc. (KYMR) to accelerate the development and commercialization of a class of drugs with potential use in cancer treatment.

The drugs belong to a class called molecular glue degrader (MGD), and they target cyclin-dependent kinase 2 (CDK2), a key contributor to tumor growth. CDK2-directed MGDs are a new type of drug designed to remove CDK2 rather than just inhibiting its function.

The drugs have a broad oncology treatment potential, including in breast cancer and other solid tumors, the companies said.

Under the terms of the agreement, Kymera is eligible to receive up to $750 million in total payments, including up to $85 million in upfront and potential option exercise payments.

Kymera may also receive tiered royalties ranging from high single-digit to mid-teens on net product sales under the collaboration.

Kymera said that it will lead all research activities for the CDK2 program. If Gilead exercises its option to exclusively license the program, Gilead will have global rights to develop, manufacture, and commercialize all products resulting from the collaboration, the companies said.

The transaction is expected to reduce Gilead’s full-year adjusted earnings per share by approximately $0.02 - $0.03. The company in April estimated adjusted and diluted EPS in the range of $7.70 and $8.10 for the full year.

Both KYMR and GILD stock are down by 2% on Wednesday morning trading.

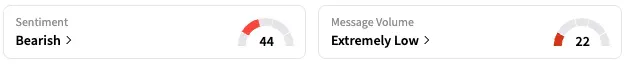

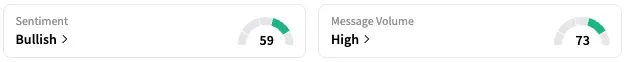

On Stocktwits, retail sentiment around KYMR is trending in the ‘bearish’ territory, while sentiment around GILD remained unchanged within ‘bullish’ territory.

KYMR shares have risen over 14% this year while GILD soared by about 14%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1463539842_jpg_bcfa58ea0b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_stock_jpg_167f2bc3dd.webp)