Advertisement|Remove ads.

Glenmark Smashes To Fresh Highs: SEBI RA Prabhat Mittal Sees Another 25% Upside Ahead

Glenmark Pharmaceuticals surged to a new all-time high in Thursday’s trade before closing up 5.5% at ₹1,919.60.

The stock outperformed the broader pharma sector, which faced selling pressure following U.S. President Donald Trump’s remarks about imposing 200% tariffs on the sector under Section 232.

Glenmark stock’s strength is backed by a solid technical setup, indicating potential for further upside, remarked SEBI-registered analyst Prabhat Mittal.

On the daily chart, it has formed a rounding bottom pattern, a classic bullish signal suggesting long-term accumulation and breakout potential, Mittal said.

The stock is also trading above its 20, 50, and 100-day moving averages (DMA), indicating strong trend alignment. Additionally, the moving average convergence/divergence (MACD) has given a fresh buy signal, reinforcing positive momentum, he added.

Glenmark stock confirmed a breakout once it breached its previous record high of ₹1,831 (recorded on October 15, 2024) earlier in the day. It had served as a strong resistance level.

Mittal recommends taking up new positions at ₹1,887 with a strict stop loss at ₹1,789.

Upside targets are placed at ₹2,200 and ₹2,400 in the short to medium term, provided the breakout sustains with volume support, he added. The upper end of the target represents a 27% premium.

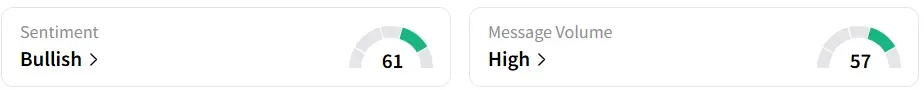

Glenmark was the top trending stock on Stocktwits. The retail sentiment turned ‘bullish’ from ‘neutral’ a day earlier, amid high message volumes.

Year-to-date (YTD), the stock gained over 19%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)