Advertisement|Remove ads.

Globalstar Stock Jumps After 1-for-15 Reverse Split, Nasdaq Shift: Retail Traders Stay Bullish

Globalstar, Inc. (GSAT) shares rallied on Tuesday as they began trading on a reverse split-adjusted basis. The company’s shares were also uplisted to Nasdaq from the NYSE American exchange.

Both the changes took effect before the stock opened for trading on Tuesday.

The Covington, Los Angeles-based mobile satellite services company said the transfer of listing to the Nasdaq exchange will help the company’s inclusion in the Nasdaq Composite Index upon meeting the eligibility criteria.

The reverse split was implemented in a 1-for-15 ratio.

In its Investor Day held in late December, Globalstar reiterated its 2024 revenue guidance in the range of $245 million to $250 million and adjusted earnings before interest, taxes, depreciation and amortization (EBITA) margin of 54%.

The company initiated its fiscal year 2025 revenue guidance of $260 million to $285 million and adjusted EBITDA margin of about 50%, underpinned by incremental strategic investments in terrestrial networks and other long-term growth initiatives.

Globalstar’s network of 31 L-band satellites are used by Apple, Inc. (AAPL) to help iPhones access emergency services where terrestrial networks are unavailable.

In November, Globalstar announced an updated services agreement with Apple that provided for cash prepayments of up to $1.1 billion. The financing would go toward capital expenditures required in connection with the extended MSS Network.

Apple also agreed to buy 400,000 Class B units in the GlobalStar SPE, representing a 20% equity interest, for $400 million by the Nov. 5 deal closing date.

Globalstar now faces competition from Elon Musk’s SpaceX-owned Starlink. Starlink has partnered with T-Mobile US, Inc. (TMUS) for a satellite connectivity service that allows text messages from mobile dead zones. The service recently entered public beta testing.

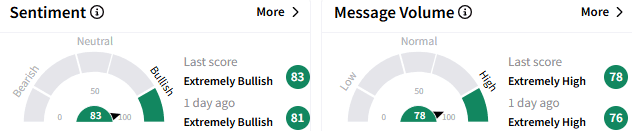

On Stocktwits, retail sentiment toward Globalstar stock stayed ‘extremely bullish’ (83/100), with the message volume remaining ‘extremely high.’

The stock was among the top 20 trending tickers on the platform. It traded up 3.08% at $24.12 in afternoon trading.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)