Advertisement|Remove ads.

Globalstar Taps SpaceX For Next‑Gen Satellite Deployment: Retail’s Jubilant

Globalstar Inc. (GSAT), a provider of telecom infrastructure and satellite-based services, has inked a deal with SpaceX to launch its upcoming satellites aboard a Falcon 9 rocket next year under a 2022 procurement agreement with MacDonald, Dettwiler and Associates Corporation (MDA).

Globalstar stock traded 4.6% higher on Monday following the news.

The mission with SpaceX will include a batch of new satellites designed to operate alongside Globalstar’s current second‑generation constellation.

The Federal Communications Commission (FCC) has granted a new 15-year license through the HIBLEO-4 filing. Globalstar anticipates the launch to occur next year after its initial foray this year.

By expanding its in-space assets, Globalstar aims to strengthen its position in the next-generation telecommunications market.

“These satellites, constructed by our partners at MDA and Rocket Lab, will enhance our ability to provide the highest quality satellite services to our customers over the long-term,” said CEO Paul Jacobs.

Globalstar’s low Earth orbit (LEO) satellite network supports secure communications for individuals, businesses, and governments worldwide. The company also offers licensed terrestrial spectrum for private wireless networks.

Its portfolio includes SPOT GPS devices and advanced IoT hardware and software for asset tracking, data analytics, and edge computing to boost operational safety and efficiency.

Globalstar’s first-quarter (Q1) revenue increased 6% year-on-year to $60 million, missing the analyst consensus estimate of $63.8 million, as per Finchat data.

The company’s loss per share of $0.16 also missed the consensus estimate of a loss of $0.03 per share. Globalstar expects its 2025 revenue to be between $260 million and $285 million.

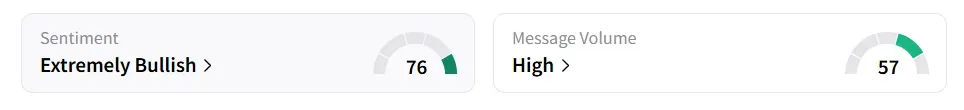

On Stocktwits, retail sentiment towards Globalstar improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. The message volume jumped to ‘high’ from ‘normal’ levels in 24 hours.

Globalstar stock has lost over 17% year-to-date and gained over 30% in the last 12 months.

Also See: Crypto Miner Bit Digital Stock Pops On Reaching 100K ETH Reserves: Retail’s Exuberant

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Door_Dash_jpg_1088720ba5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_thiel_OG_jpg_9d74d987ca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)