Advertisement|Remove ads.

GM Breweries Surges To 52-Week High On Robust Q2 Earnings

Shares of GM Breweries surged 17.4% to ₹896.90 on Thursday after the company posted outstanding second-quarter results.

The company’s profit for the period surged 61% to ₹34.89 crore, compared to ₹21.67 crore last year. Total revenue from operations rose 20% to ₹717.85 crore from ₹598.81 crore. Margins saw a healthy growth, at 24.9% compared to 18.9% last year.

This marks a significant improvement over the previous quarter’s performance, with the EBITDA margin contracting to 18.98% from 20.67%.

Analyst View

Analyst Finkhoz RoboAdvisory noted that on the weekly chart, the stock has broken out above the long-term ₹713 resistance zone on heavy volume. The weekly Relative Strength Index (RSI) is above 72.

They now see the old resistance zone of ₹713–720 acting as support, with an upside target of ₹1,000. While Finkhoz cautioned that a bit of profit booking could be on the cards, many believe this stock could be due for a valuation re-rating if the company sustains this growth and profitability.

Stock Watch

GM Breweries' stock surged to its highest in over a year after reporting its Q2 print. The stock posted its best intraday performance since October 3, 2024, ahead of its Q2 earnings results.

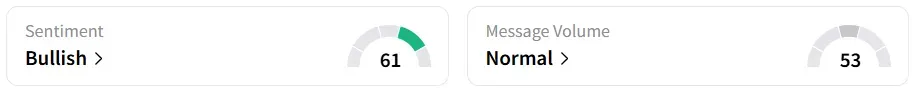

Retail sentiment on Stocktwits immediately turned to ‘bullish’ following the results. It was unchanged at ‘neutral’ for a year. It was the top trending stock on Stocktwits.

This also marks the stock’s sixth straight day of gains, adding nearly 28% during the period, albeit heavily influenced by today’s advance.

Excluding today’s gains, the stock has declined 6% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)