Advertisement|Remove ads.

GM Secures Rare Earth Magnet Supply From Texas Partner Amid Push to Mitigate Tariffs

Texas-based Noveon Magnetics said on Wednesday that it has entered into a multi-year supply agreement with automaker General Motors (GM) to deliver rare earth magnets.

The company said that it began delivering magnets to support GM's full-size SUVs and trucks in July.

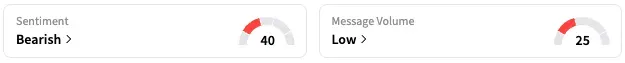

On Stocktwits, retail sentiment around GM trended in the ‘bearish’ territory over the past 24 hours while message volume remained at low levels.

"Working with domestic manufacturers like Noveon allows us to increase the resiliency of our supply chain while supporting American jobs and strengthening our industry and economic security," said Jeff Morrison, General Motors' global chief procurement officer.

The new agreement announcement comes on the heels of the company committing to grow its domestic supply chain during its second-quarter earnings call last month in an attempt to reduce the impact of tariffs imposed on imports.

“For the full year, while there have been some puts and takes since we gave our initial guidance, our gross tariff impact remains unchanged at $4 billion to $5 billion this year as we continue to produce and import vehicles from Canada, Mexico and Korea to avoid interruptions for our customers and dealers,” company CFO Paul Jacobson said.

However, the company is attempting to mitigate at least 30% of this $4 billion to $5 billion impact through manufacturing adjustments, targeted cost initiatives, and consistent pricing, it said.

In Q2, GM incurred a $1.1 billion net impact from tariffs. The company also noted that it believes the third-quarter net impact will be higher than in Q2 due to the timing of indirect tariff costs.

In June, GM announced a $4 billion investment into its U.S. assembly plants to add 300,000 units of capacity, and reduce tariff exposure on vehicle imports while continuing to satisfy customer demand.

GM stock is down by 2% this year but up by about 28% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)