Advertisement|Remove ads.

PayPal Investor Day Sees Earnings Projections, Platform Consolidation Take Centre Stage: Stock Declines, Retail’s On The Fence

PayPal Holdings Inc. (PYPL) shares were in the spotlight on Tuesday after the company disclosed long-term earnings projections and consolidated most of its offerings under a single umbrella.

PayPal expects high single-digit transaction margin dollar growth and low teens non-GAAP earnings per share (EPS) growth by 2027.

CEO Alex Chriss said the company’s vision is to become a commerce platform that powers the global economy. “…we have the scale, ubiquity, and data advantages to make that happen,” he said.

According to a Bloomberg report, transaction margin dollars—an important metric for the firm—are expected to rise by high single-digit percentages over the next two years, likely hitting 10% or more after that.

PayPal is also announcing its new merchant offering, PayPal Open, which is touted as a single platform for all businesses.

The company explained that businesses can quickly discover and integrate commerce enablement tools, from payments to financial services to risk solutions within the PayPal ecosystem.

The platform, which also integrates with external commerce partners, will soon be available in the U.S. and expand to the U.K. and Germany next year, with additional markets to follow.

The company also announced an expanded partnership with Verifone to offer omnichannel payment acceptance solutions to enterprise merchants. This will bring Verifone's in-person payment assets together with PayPal's enterprise payment processing and e-commerce capabilities, Braintree.

Meanwhile, PayPal also expanded its strategic relationship with J.P. Morgan Payments to offer Fastlane for its merchant clients in the UK and Europe. The company claims Fastlane is a guest checkout experience that can accelerate customers' checkout speeds by over 36% compared to a traditional guest checkout.

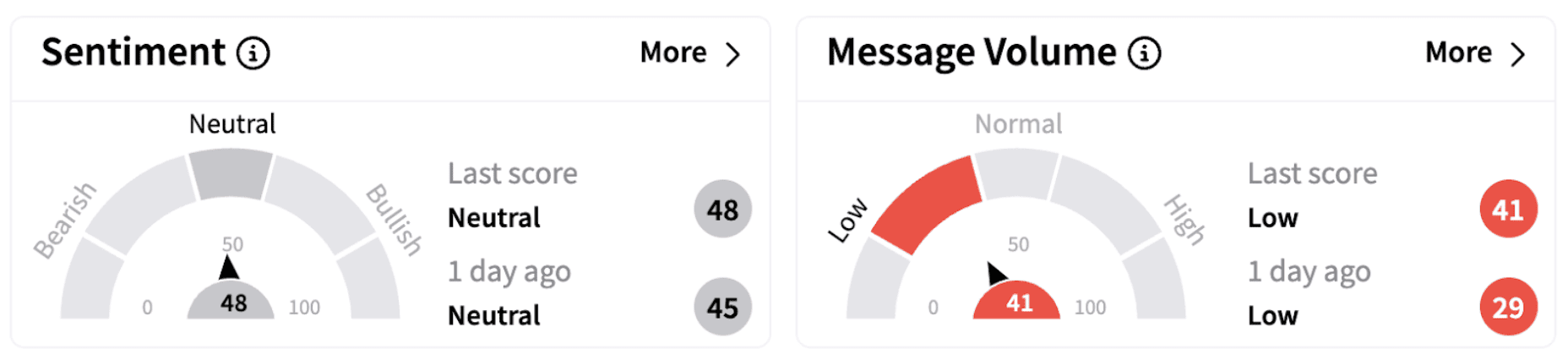

On Stocktwits, retail sentiment surrounding PayPal climbed higher but continued to trend in the ‘neutral’ territory (48/100).

According to TheFly, Wolfe Research believes the low teens and above EPS growth expectation by 2027, branded commentary on acceleration between 8% and 10%, and long-term aspirations of over 20% for EPS growth are generally above expectations over the medium term.

Wolfe Research has an ‘Outperform’ rating on the stock with a $97 price target.

On Tuesday afternoon, PayPal shares traded down over 2%, aligning with the broader market movement. The stock has lost over 14% in 2025 but has gained over 24% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)