Advertisement|Remove ads.

Goodyear Tire's Post-Earnings 20% Plunge Doesn't Shake Retail Bulls Even As Wall Street Analysts Remain Split

Goodyear Tire & Rubber Co. (GT), once seen as relatively shielded from U.S. tariff pressures, is now feeling the full impact, as reflected in its latest quarterly results last week. Still, some retail investors are taking a bullish stand.

GT shares have dropped nearly 20% since Thursday’s close, when the company reported a swing to an adjusted loss and a sharper-than-expected sales decline, driven largely by tariff-related disruption in the tire and automotive industries.

Since then, analysts have lowered their view on the company's financial health. BNP Paribas Exane slashed its rating on the stock to 'neutral' from 'outperform' and price target to $9 from $15 following the quarterly report, adding that a recovery will "likely take longer than expected."

On Monday, Deutsche Bank cut its price target by $3 to $12, but retained its ‘Buy’ rating.

Currently, half of the analysts covering the stock have a 'buy' or higher rating, and the other five rate it 'hold,' according to Koyfin data. Their average price target is $12.17, which implies an over 47% upside to the stock's last close.

"The second quarter proved challenging in both our consumer and commercial businesses, driven by industry disruption stemming from shifts in global trade - including a surge of low-cost imports across our key markets," Goodyear CEO Christina Zamarro said in the earnings press release.

Goodyear’s Polish subsidiary, Firma Oponiarska Dębica, said on Tuesday it will scale back 2025 production after the U.S. tire maker reduced its orders. The company now expects passenger car tire output next year to be 4.49% below its original forecast, warning that the cut could negatively impact financial results.

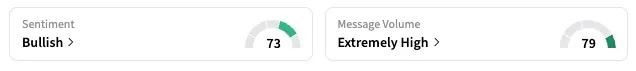

On Stocktwits, retail sentiment has held at the 'bullish' zone for Goodyear since its Thursday report, with several users calling the stock an attractive buy at current levels.

"$GT fair value around $19, load these cheapies. I can see 10.50-11 in [the] short term," a user said.

The U.S. has imposed a 25% tariff on imported automobiles and auto parts, in addition to existing country-specific duties. After an early sales surge driven by buyers rushing to avoid price hikes, vehicle demand has since slowed, adding pressure on the tire industry.

Goodyear shares are down 8.3% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_china_00822840c6.webp)