Advertisement|Remove ads.

Gorilla Technology Stock Drifts Toward 10-Month Lows As $1.4B AI Contract Shifts To Phased Rollout

- Revenue from the Freyr deal will be recognized as deployments are completed, starting with the initial phase.

- The company has about $85 million in signed contracts, with timing driving its outlook.

- Gorilla said it is focused on scaling infrastructure execution in 2026.

Gorilla Technology’s stock traded near its lowest levels in more than 10 months as investors focused on the timing of revenue from the company’s largest contract, following new details shared by the company during a recent fireside chat.

At the time of writing, the stock fell 7.5% to $12.

During the discussion, Gorilla confirmed that its roughly $1.4 billion, three-year AI infrastructure agreement with Freyr is moving into a phased deployment rather than contributing meaningfully to near-term revenue all at once. The company said the first phase, valued at about $300 million, is currently being launched in Thailand, with additional phases expected to follow as project milestones are completed.

Revenue Visibility Hinges On Execution Timing

CEO Jayesh Chandan said Gorilla currently has about $85 million in signed contracts and backlog, with overall revenue guidance for 2026 driven largely by the timing of deployments rather than demand. He noted that the rollout schedule for the initial Freyr deployment in the first half of 2026 remains the biggest swing factor for the company’s outlook.

The company added that later phases of the Freyr project, including an additional $450 million phase, are being worked on in parallel but will require completion of statements of work and service-level agreements before progressing.

Focus On Infrastructure Build-Out

Chandan said Gorilla is now operating as an infrastructure execution company rather than a proof-of-concept provider, highlighting national-scale deployments across AI infrastructure, data centers and sovereign security platforms. The company is coordinating closely with hardware partners, including NVIDIA, to secure delivery timelines for GPUs used in its AI data center programs.

He added that Gorilla is expanding its engineering and research and development teams across Thailand, India and Taiwan, while also opening new offices in Singapore and Indonesia to support the delivery pipeline.

2026 Framed As A Scale Year

Looking ahead, Gorilla described 2026 as a year focused on scaling operations with discipline. Chandan said Gorilla’s guidance reflects conservative assumptions, including limited contribution from later phases of the Freyr contract, even as the company works toward building predictable, recurring infrastructure revenue over time.

He also noted that Gorilla ended the period with more than $110 million in cash, reduced debt levels below $15 million, with additional collections expected in the coming weeks, giving the company flexibility to execute large infrastructure deployments without immediate reliance on equity markets.

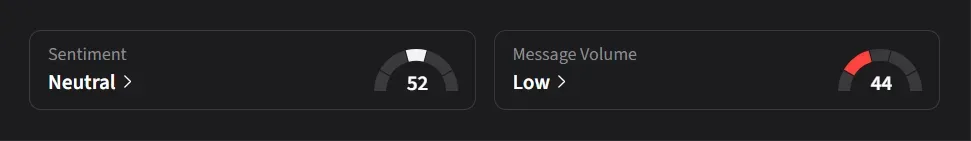

How Did Stocktwits Users React?

On Stocktwits, retail sentiment was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “power hour Jay. Put your money where your mouth is and turn this around!”

Another user viewed the pullback as an opportunity, describing the company as "solid" and suggesting the lower prices could be a chance to add shares.

Gorilla’s stock has declined 34% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)