Advertisement|Remove ads.

Greenlane Stock's Retail Following Surges 20% In A Week: Here's Why

Greenlane Holdings (GNLN) has become a retail investor darling, attracting a 20% surge in new followers on Stocktwits over the past week. The company's stock price has risen nearly 6% during the same period.

Driving this interest is a combination of factors. Greenlane recently announced an exclusive distribution deal for fentanyl and xylazine detection test strips, capitalizing on the growing concern over drug overdoses.

Additionally, the company's CEO bought 12,500 common shares of the company in the open market, at an average price of $2.66 per share, signaling confidence in Greenlane's future.

Greenlane also announced it had entered into a securities purchase agreement with a large institutional investor for aggregate gross cash proceeds of $6.5 million, dampening investor sentiment.

There was also some profit-taking on Friday, as the stock dropped over 21% to $10.30, following the near 210% rally over the last month.

Greenlane's year-to-date performance remains impressive, with a gain of over 85%, comfortably outperforming the S&P 500 and the Nasdaq.

The company's small float of less than 530,000 shares has contributed to heightened volatility.

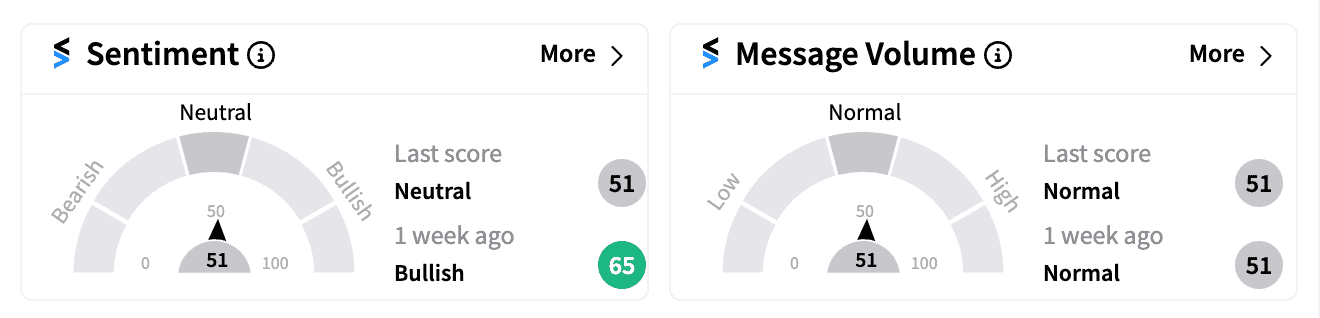

While the recent distribution deal and CEO buy have generated excitement, the current sentiment on Stocktwits has flipped to ‘neutral’ (49/100) from ‘bullish’ (67/100) a week ago, indicating cautiousness from retail investors.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)