Advertisement|Remove ads.

Guidewire Stock Rises After-Hours On Beat-And-Raise Q2, But Retail Traders Grow More Wary

Guidewire Software, Inc. (GWRE) stock rose in Thursday’s after-hours trading after the provider of a cloud platform for property and casualty (P&C) insurance companies announced a quarterly earnings beat and raised its fiscal year 2025 guidance.

The San Mateo, California-based company reported an adjusted earnings per share (EPS) of $0.51 for the second quarter of the fiscal year 2025. This marked an improvement from the year-ago quarter’s 0.46 and aligned with the Finchat-compiled consensus estimate.

Revenue jumped 20% year over year (YoY) to $289.5 million versus the $285.74-million consensus estimate. The topline also beat the guidance of $282 million to $288 million.

Mike Rosenbaum, CEO of Guidewire, said, “We delivered another excellent quarter driven by 12 cloud deals, with the majority at larger insurers who demand a platform that can handle their complexity and scale.”

CFO Jeff Cooper noted that annual recurring revenue (ARR), revenue and profitability finished above the high end of the company’s outlook ranges in the second quarter.

ARR at the end of the quarter was $918.1 million versus the $909 million to $914 million consensus.

Guidewire guided third-quarter adjusted operating income of $36 million to $42 million, revenue of $283 million to $289 million and quarter-end ARR of $942 million to $947 million.

The revenue guidance exceeded the consensus estimates of $279.35 million.

Guidewire raised its fiscal year 2025 revenue guidance to a range of $1.164 billion to $1.174 billion from $995 million to $1.005 billion. It also increased the adjusted operating income guidance to $175 million to $185 million and ARR guidance to $1 billion to $1.01 billion.

Cooper attributed the guidance raise to the second-quarter outperformance, combined with visibility into ARR from ramps in the second half of the year and a healthy pipeline.

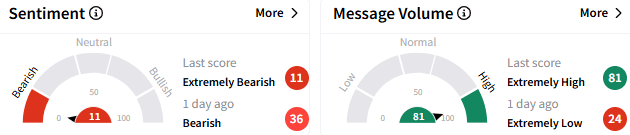

On Stocktwits, retail sentiment toward Guidewire stock turned to ‘extremely bearish’ (11/100) from ‘bearish’ a day ago. On the other hand, retail chatter grew louder to ‘extremely high’ levels.

A bearish watcher called the stock ‘overvalued.’

Another expected the stock to give up its after-hours gain and tank on Friday.

Guidewire stock rose 1.08% to $189 in Thursday’s after-hours trading. The stock has added about 11% year-to-date.

For updates and corrections email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)