Advertisement|Remove ads.

H&E Equipment Services Stock Hits Record High After Better Acquisition Offer From Herc Holdings: Retail Cheers The Deal

Shares of H&E Equipment Services (HEES) soared over 12% to hit record highs on Tuesday after the rental equipment company said it had received a superior acquisition proposal from Herc Holdings Inc. (HERC) compared to that of United Rentals, Inc. (URI).

Under the terms of the Herc proposal, H&E shareholders would receive $78.75 in cash and 0.1287 shares of Herc common stock for each share they own, with a total value of $104.89 per share. This is based on Herc’s 10-day volume-weighted average price (VWAP) as of market close Feb. 14, 2025.

Once the deal is closed, H&E’s shareholders would own approximately 14.1% of the combined company. Earlier, United Rentals had said it would acquire H&E Equipment Services for $92 per share in cash.

Herc said its proposal represents a 14% premium to United Rentals’ cash-capped consideration.

It also believes the proposal enables H&E’s shareholders to share in the value created from the $300 million of earnings before interest, tax, depreciation, and amortization (EBITDA) benefits expected to be generated by the end of the third year following close.

However, under the merger agreement with United Rentals, H&E must pay a termination fee of approximately $63.5 million to United Rentals if H&E terminates the merger agreement to enter into an agreement with Herc.

United Rentals also clarified it does not intend to submit a revised proposal for the acquisition of H&E, which will permit H&E to terminate United Rentals’ previously announced merger agreement.

Herc’s CEO Larry Silber said the company is pursuing the proposed combination with H&E from a position of strength and views it as a path to accelerate Herc’s strategy and growth trajectory.

“Herc’s cash and stock merger consideration provides H&E shareholders with an immediate and significant premium. In addition, by combining our companies, we would unlock substantial upside opportunity for both Herc and H&E shareholders,” he said.

Following the developments, shares of Herc Holdings tumbled over 14% on Tuesday morning, while United Rentals’ stock was down over 3%.

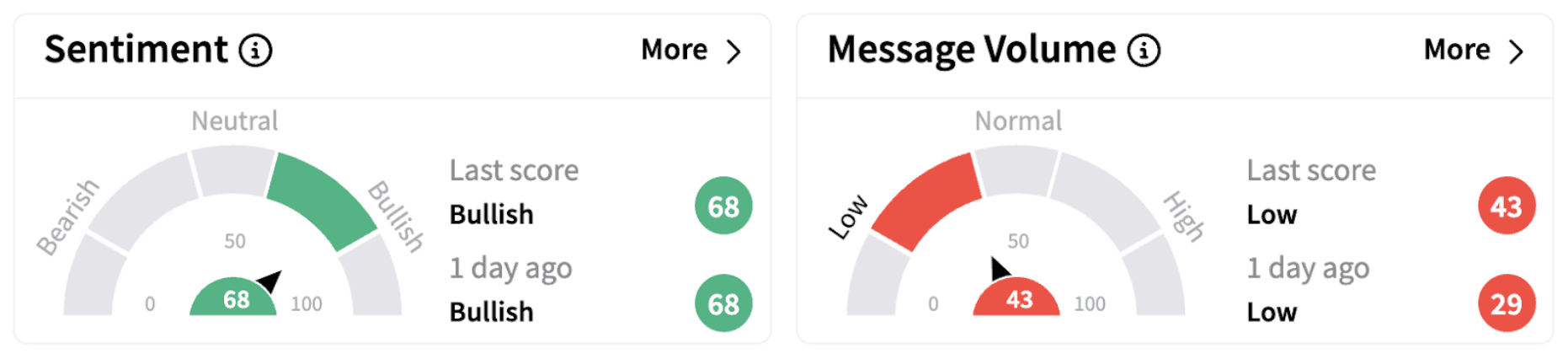

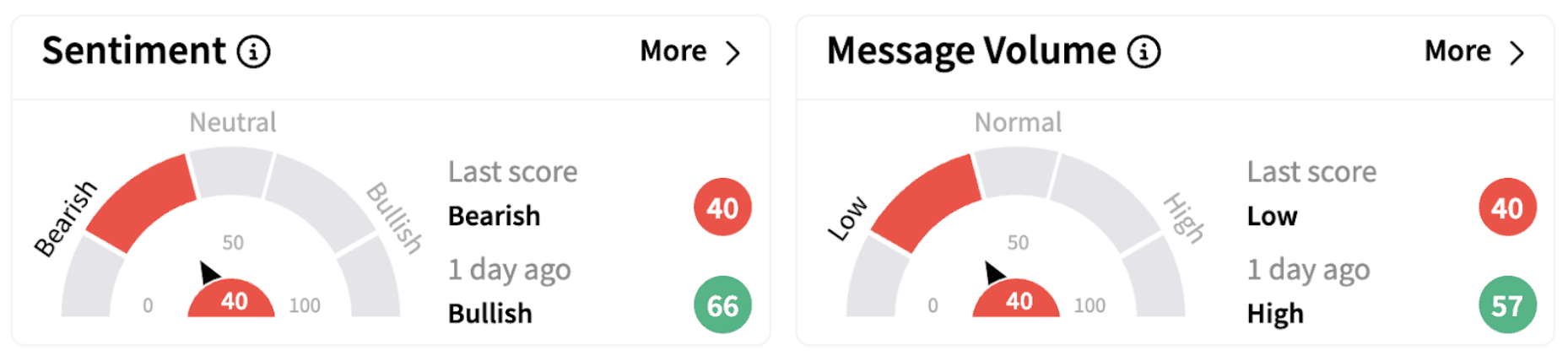

On Stocktwits, retail sentiment surrounding HEES stock continued to trend in the ‘bullish’ territory (68/100), but URI and HRI shares witnessed ‘bearish’ takes on the stock.

HEES shares have more than doubled in 2025 and have gained over 82% over the past year. Herc Holdings’ shares have lost over 6% year-to-date but are up over 18% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_85ede3fab5.webp)