Advertisement|Remove ads.

HDFC AMC Shows Fatigue Post Q1 Results Rally; SEBI RAs See Resistance Around ₹5,630

HDFC AMC stock is showing signs of fatigue after its rally last week, driven by solid June quarter (Q1FY26) results, said SEBI-registered analyst Anupam Bajpai.

HDFC AMC shares rebounded from their 200-day moving average on July 14, Bajpai noted. The stock surged 3.77% on July 15, triggering a short-term uptrend. From July 15 to 18, it maintained a streak of positive daily closes, a clear sign of bullish sentiment.

It surged more than 10% over the past week. On Monday, the stock ended 0.64% higher at ₹5,626.

However, current technical indicators hint at potential fatigue. On July 18, the stock closed significantly above the upper Bollinger Band, while the Relative Strength Index (RSI) reached 74, suggesting overbought conditions. Such a setup typically precedes a short-term pullback or sideways consolidation, he added.

Bajpai recommends keeping an eye out for a possible retracement toward the 20-day moving average, which may act as a support zone. On the upside, ₹5,630 stands as a crucial resistance level. A decisive breakout above this with strong volume could revive bullish momentum, he added.

Traders could look to book partial gains or protect profits using trailing stop-losses. A brief correction would be constructive, helping the stock build a stronger base for a potential move higher, Bajpai concluded.

SEBI-registered analyst Financial Independence suggests buying HDFC AMC only if it breaks above ₹5,655 in the cash market. Alternatively, traders can consider positions in F&O or opt for the ₹5,700 Call Option (CE).

HDFC AMC reported a 24% increase in net profit to ₹748 crore, and a 25% increase in revenue to ₹968 crore. It also reported a 23% jump in average assets under management (AUM) to ₹8.3 lakh crore.

Last week, Nuvama Institutional Equities raised the stock’s target price to ₹6,530 from ₹5,840, while maintaining its ‘Buy’ rating following strong quarterly results.

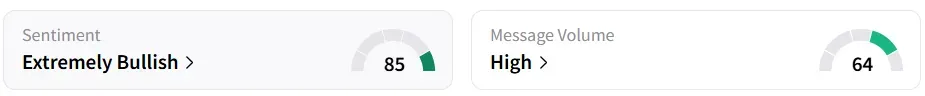

Meanwhile, the retail sentiment on Stocktwits remains ‘extremely bullish’ amid ‘high’ message volumes. It was ‘neutral’ a week earlier.

The stock has added a third of its total value year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)