Advertisement|Remove ads.

HDFC Bank Eyes Breakout Ahead Of Q1 Results: SEBI RA Sees Smart Accumulation As Bonus Buzz Builds

HDFC Bank traded cautiously on Wednesday as the lender gears up to announce its first-quarter (Q1FY26) earnings later this week. The bank's board will also consider a bonus issue of shares at a meeting on July 19. If approved, this would mark the first such action by India's largest private lender.

HDFC Bank was among the top trending stocks on Stocktwits at the time of writing.

SEBI-registered analyst Vijay Kumar Gupta is moderately bullish on HDFC Bank as the stock has reclaimed ₹2,000 with strength after forming a near-term base. He believes that the risk-reward appears favourable if supported by volumes.

Technical Trends

On the technical charts, he observed that the price has bounced from the Ichimoku baseline (Kijun-Sen) and is now above the cloud and conversion line, suggesting a bullish undertone.

The Commodity Channel Index (CCI) is at 80.89, indicating strong momentum building, but watch for divergence, he cautioned. The On-Balance Volume (OBV) is stable with a gradual uptick, suggesting smart accumulation.

Gupta noted that a volume breakout is possible if it sustains above ₹2,010. Bollinger Bands show squeeze breakout potential if ₹2,025 is cleared on a closing basis.

Q1 Expectations

The street is expecting a stable Net Interest Margin (NIM) and double-digit credit growth. The bank’s loan book growth is likely to be driven by retail and corporate segments post-merger with HDFC.

Investors will also be watching for its CASA (Current Account Savings Account) retention and margin management in the rising cost cycle. Positive commentary regarding the execution of HDFC integration is also keenly anticipated.

Analysts are optimistic about the cost synergies from the merger, estimating savings of ₹15,000–18,000 crore over 3–5 years.

In other news triggers, the Reserve Bank of India’s (RBI) new repo-linked home loan rates are favourable to HDFC Bank’s retail growth, noted Gupta. He also sees a likely rise in fund flows from domestic institutions ahead of its results.

Gupta has identified resistance at ₹2,025 and ₹2,040, with support at ₹1,995 and ₹1,970 levels. A sustained close above ₹2,025 can trigger a bullish breakout towards ₹2,080, he added.

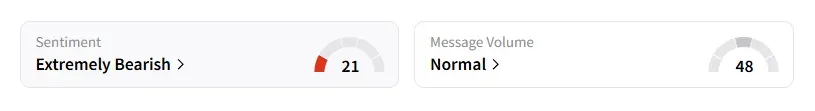

However, data on Stocktwits shows that retail sentiment moved to ‘extremely bearish’ a day ago.

HDFC Bank shares have risen 12% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)