Advertisement|Remove ads.

Hedge Fund Reportedly Prepares To Launch Board Fight At OraSure Technologies: Retail Investors Believe It’s Good News

Altai Capital Management is reportedly preparing to launch a board fight at medical device company OraSure Technologies (OSUR).

The hedge fund is one of the biggest owners of OraSure and built up its stake from 3% at the end of June to 5% in recent weeks, Reuters reported, citing two people familiar with the matter.

The larger stake allows Altai to press its case for board representation more forcefully, the people told Reuters. Two OraSure directors will stand for reelection at next year's annual meeting, and Altai is likely to nominate two candidates, including its founder, Rishi Bajaj, at some point, the report stated. Bajaj last year suggested that an investor with experience in capital allocation should join the OraSure board, the sources told Reuters.

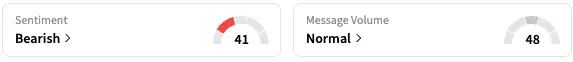

Shares of the company traded 2% higher at the time of writing. On Stocktwits, retail sentiment regarding OSUR stock remained in ‘bearish’ territory over the past 24 hours, while message volume remained at ‘normal’ levels.

A Stocktwits user believes it’s ‘good news’.

However, another user cheered for the Altai founder.

Last month, Reuters reported that OraSure Technologies (OSUR) received a letter from healthcare entrepreneur Ron Zwanziger stating that he may pursue a more "adversarial path" if the board continues to resist his offer to buy the company.

Zwanziger made an unsolicited all-cash offer to buy OraSure for between $3.50 and $4.00 a share in June but was rebuffed. The entrepreneur stated in his letter that other investors have grown concerned and reached out to him.

"If the board is not willing to entertain a collaborative discourse, we will be left with no choice but to consider all alternatives available," the letter said, without detailing the alternative options. "We would prefer to work together with you in a collaborative fashion to realize the full value potential for all shareholders, rather than pursuing a more adversarial path," the letter stated, as per the report. However, Altai and Zwanziger are not working together, Reuters said on Tuesday.

For the three months through the end of June, OraSure’s total net revenues fell 43% year-on-year to $31.24 million, while diluted and adjusted loss per share stood at $0.19 compared to a profit of $0.08 in the corresponding quarter of 2024.

OSUR stock is down 8% this year and approximately 21% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202902434_jpg_34a840ada1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_CZ_ZHAO_OG_2_jpg_f6124171e0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248471134_jpg_9957fc576c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tandem_diabetes_resized_jpg_5f199c73c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)