Advertisement|Remove ads.

Hims & Hers Announces New $250 Million Share Repurchase Program – Retail Sees A Steady Trading Range For The Stock

- The share buyback will be carried out over the next three years.

- Under the new buyback program, Hims & Hers can repurchase shares at its discretion.

- Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a session earlier.

Hims & Hers Health, Inc. (HIMS) on Monday announced that its board has approved a new $250 million share repurchase program for its Class A common stock.

The buyback will be carried out over the next three years. This follows the company’s earlier $100 million buyback program launched in July 2024, which has now been completed. HIMS stock traded nearly 1% lower on Monday and was among the top trending tickers on Stocktwits.

The Buyback

Under the new buyback program, share repurchases may occur through open-market trades, privately negotiated deals, or preset 10b5-1 trading plans.

“We continue to see opportunities where the market value of our Class A common stock may not fully reflect what we believe is its intrinsic value. With our strong balance sheet and projected future cash flows, this new program gives us the flexibility to capitalize on those moments and continue delivering value for our shareholders,” said Andrew Dudum, co-founder and CEO of Hims & Hers Health.

Q3 Results

Earlier this month, Hims & Hers Health posted a 49% increase in third-quarter revenue to about $599 million. At the same time, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) grew to $78.4 million from $51.1 million.

The company expects fourth-quarter revenue to be between $605 million and $625 million, and adjusted EBITDA of $55 million to $65 million, implying a 9% to 10% margin.

For full-year 2025, it forecasts revenue of $2.335 billion to $2.355 billion and adjusted EBITDA of $307 million to $317 million, reflecting a 13% margin.

What Are Stocktwits Users Saying?

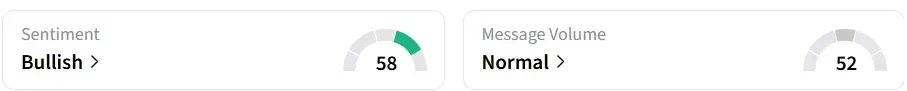

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ over the last day.

One user sees a steady trading range for the stock with support at $35.9 and resistance at $38.4.

Another user expects the stock to dip before pushing toward $40.

Year-to-date, HIMS stock has gained over 50%.

Read also: Gibraltar Strengthens Roofing Portfolio With $1.3 Billion Omnimax Acquisition

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Zscaler_jpg_c6a5978bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_warner_bros_discovery_wbd_resized_jpg_bae2c7edb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Sam_Altman_1200pi_resized_jpg_a180a65511.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)