Advertisement|Remove ads.

Honeywell Powers Up Low-Emission Fuel Push With $2.4B Deal To Buy Johnson Matthey's Catalyst Unit

Honeywell (HON) stock is set to garner retail attention on Thursday after the company agreed to buy UK-based Johnson Matthey's Catalyst Technologies business segment in an all-cash deal for £1.8 billion ($2.4 billion).

The deal, expected to close in the first half of 2026, would merge the Catalyst Technologies business with Honeywell's Energy and Sustainability Solutions (ESS) business segment.

Honeywell said that the Catalyst Technologies' business model complements its existing business of selling catalysts and process technologies.

The acquisition would also help it offer customers solutions for producing lower-emission, critical fuels, including sustainable methanol, sustainable aviation fuel (SAF), blue hydrogen, and blue ammonia.

The business unit has approximately 1,900 employees and is headquartered in London, with sites in the U.S., Europe, and India.

"As we continue to expand and evolve our ESS portfolio, acquiring Johnson Matthey's Catalyst Technologies business will provide our customers a comprehensive and cost-effective approach to transition their businesses to high-value products with lower emissions," said Ken West, CEO of Honeywell's ESS segment.

The acquisition is expected to be accretive to earnings in the first year, the company said.

Since December 2023, Honeywell has announced deals worth about $11 billion to boost its offerings.

The industrial giant is in the process of a three-way split into Aerospace, advanced materials, and automation businesses, which it announced in February amid pressure from activist investor Elliott Investment Management.

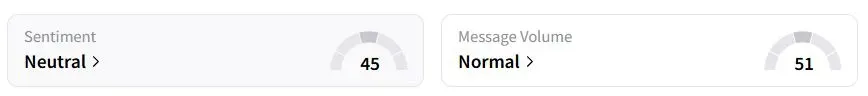

Retail sentiment on Stocktwits was in the ‘neutral’ (45/100) territory late on Wednesday, while retail chatter remained ‘normal.’

Honeywell stock has fallen 2.3% year to date (YTD).

Also See: Oil Prices Decline After Report Says OPEC+ Considering Raising Production In July

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)