Advertisement|Remove ads.

Houston American Energy Corporation Announces Leadership Change, Closure Of Private Placement: Retail Remains Confident

Houston American Energy Corporation ($HUSA), a firm involved in oil and gas exploration, announced on Monday that CEO John F. Terwilliger would be stepping down from his roles, effective Nov. 11, 2024.

The company said that Terwilliger will provide advisory services for a limited period of time to effect an orderly transition and will also continue to serve as a director of the company.

Meanwhile, the board of directors has appointed Peter F. Longo to serve as President and CEO, effective on Nov. 11, 2024. Longo will also join the board on that date.

Longo currently serves as the Chairman of Cyient, Inc. the U.S. subsidiary of Cyient, Ltd. Prior to that, he served as SVP of Operations for United Technologies Corp. ($UTC) prior to its merger with Raytheon.

Meanwhile, the board received the resignation of James A. Schoonover as a director from the board, effective Nov. 11, 2024. “Schoonover’s departure from the board was not due to any disagreement between the director and the company,” the firm said in a statement.

On Monday, the company closed a private placement offering for the issuance and sale of over 2.18 million shares of common stock “to an accredited investor.” The aggregate gross proceeds to the company from the offering stood at approximately $2.5 million, before deducting placement agent fees and other offering expenses.

The firm intends to use the net proceeds from the offering for general corporate purposes and to pursue strategic growth initiatives which may include acquisitions and investments in the energy sector.

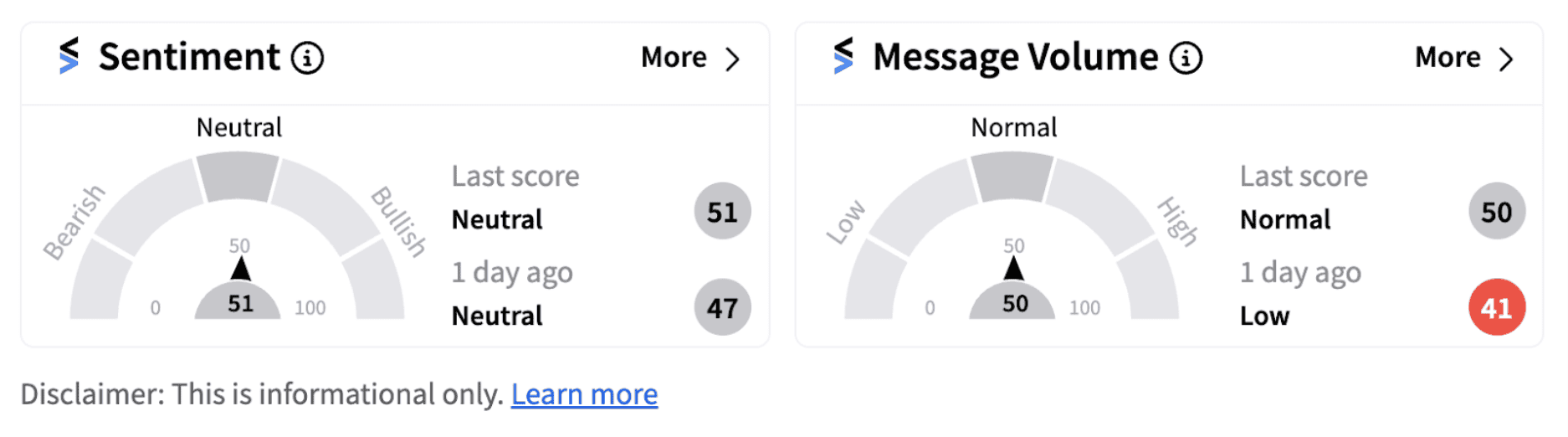

Retail sentiment on Stocktwits, however, continued to trend in the ‘neutral’ territory.

Most Stocktwits followers of the ticker expressed hope on the stock’s potential in the coming times.

Shares of the firm have lost over 25% since the beginning of the year.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)