Advertisement|Remove ads.

Detroit Strikes Back: How Ford And GM Stocks Quietly Beat Tesla And Rivian This Year

- GM and Ford have outperformed Tesla YTD, benefiting from ICE/hybrid exposure amid the EV slowdown.

- The legacy automakers dwarf Tesla in revenue, while Tesla still commands superior—but flattening—margins.

- Retail and analyst sentiment favor GM and Ford, while Tesla optimism hinges heavily on robotaxi ambitions.

The legacy automakers are back in the spotlight, with stocks of two of Detroit’s “Big Three” outperforming the gains of more nimble new-age, green-energy plays, including the electric vehicle (EV) juggernaut Tesla, this year.

They were once panned for being slow in their go-to-market strategies and technology adoption, while also grappling with high fixed and labor costs stemming from binding union contracts. Complex dealer networks further eroded their pricing power, adding to the challenges they faced.

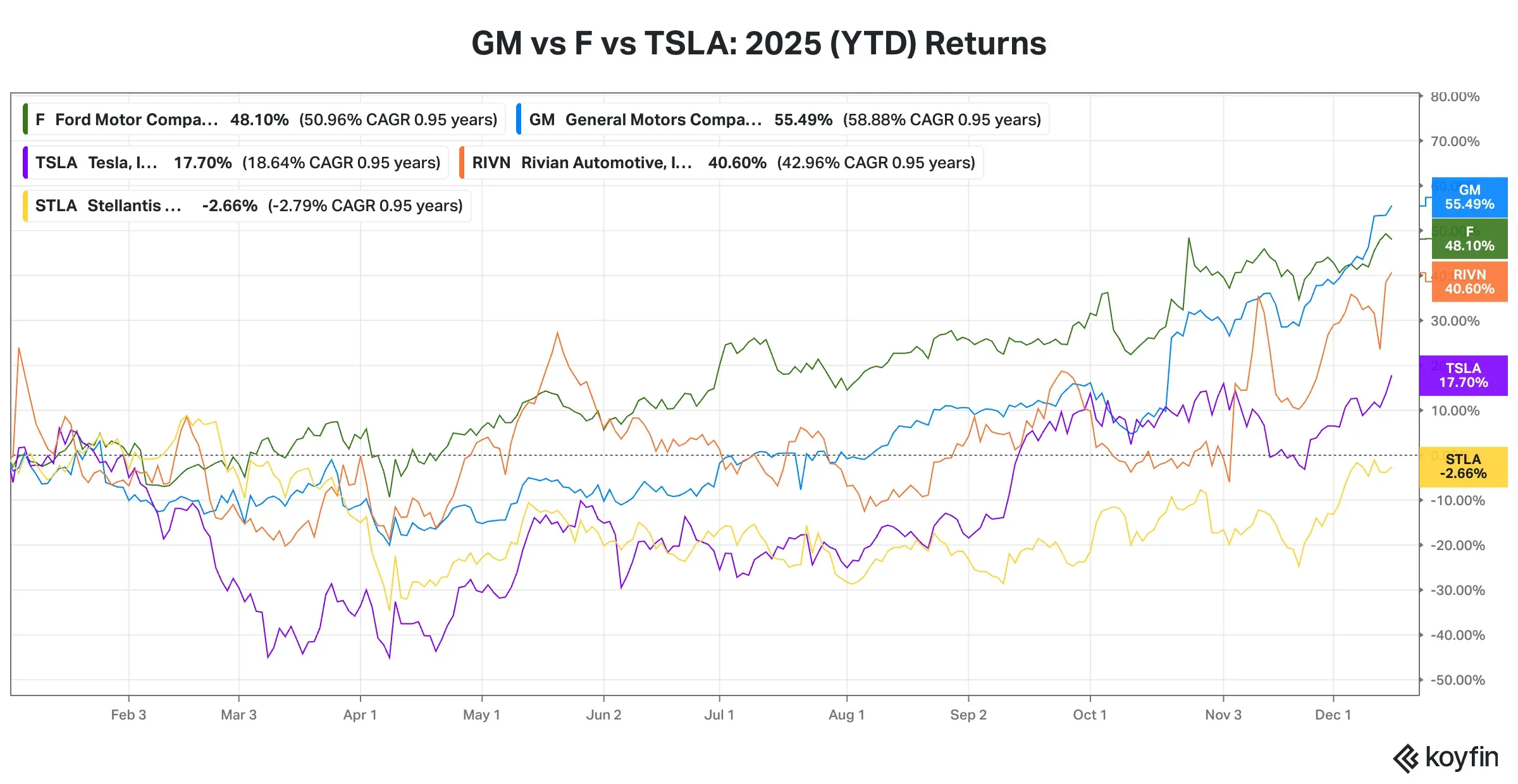

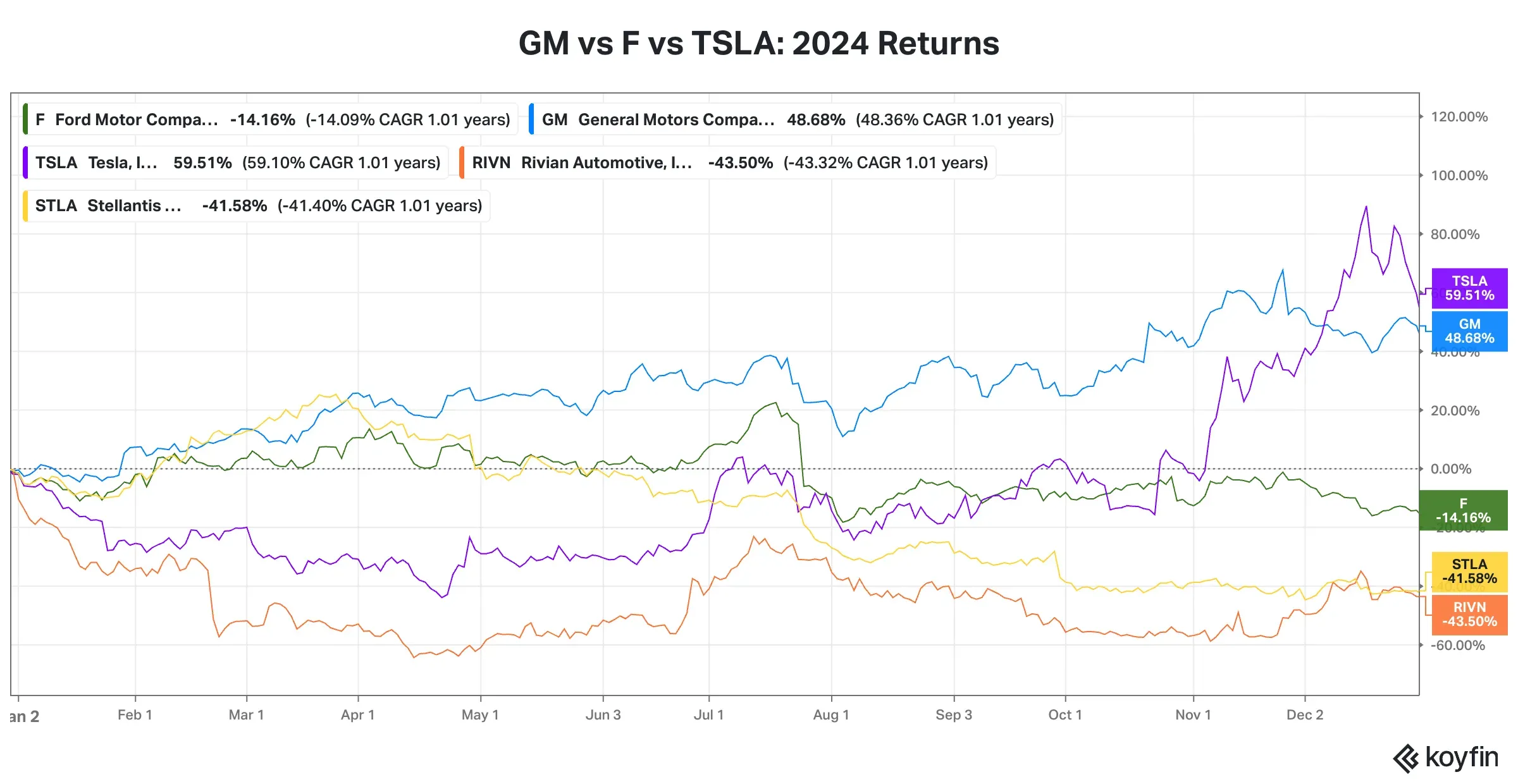

GM vs F vs TSLA: Reversing Stock Fortunes

After closing 2024 with a negative return of 14%, Ford’s stock has staged a credible comeback, rallying 48% year to date. GM’s stock has continued to build on its strong momentum, with its annual return set to surpass the 49% gain recorded in 2024; the stock is up 55% so far this year.

By contrast, Tesla’s fortunes have cooled in 2025, with the stock posting a more modest 18% gain year to date, compared with a 60% surge in 2024.

Meanwhile, Tesla’s smaller EV peer, Rivian Automotive (RIVN), has rebounded sharply from its 44% slump in 2024, climbing 41% year to date.

Source: Koyfin

Source: Koyfin

Source: Koyfin

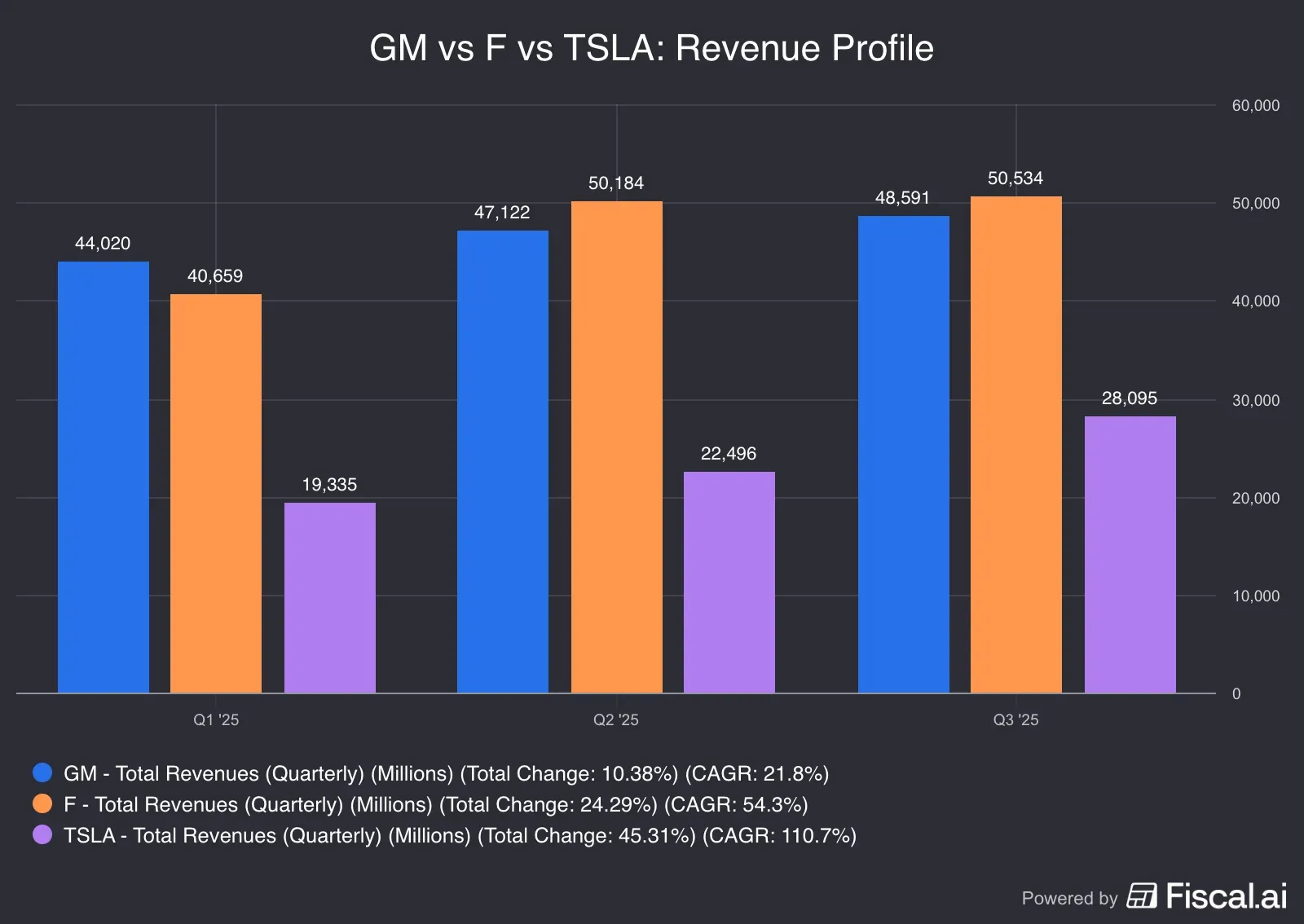

GM vs F vs TSLA: How Fundamentals Stack Up

Despite all the hype, Tesla’s revenue in the latest quarter accounted for only 70% of each of GM's and Ford’s. In terms of revenue for the YTD period, Ford is the top U.S. automaker, reporting $1.41 billion in revenue compared to GM’s $1.40 billion.

Source: Fiscal.ai

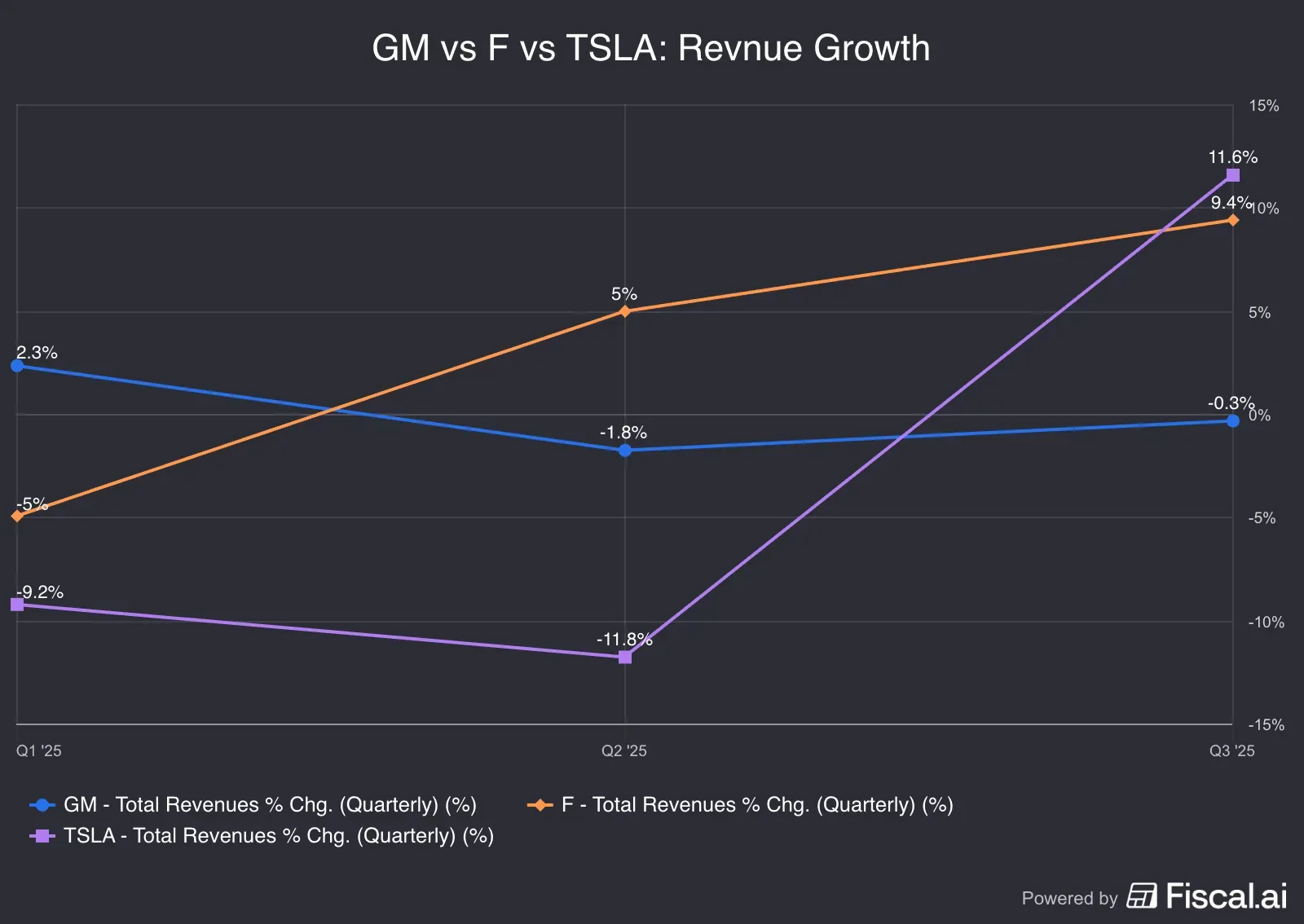

Ford has seen steadily rising year-over-year (YoY) growth, while its crosstown rival GM has underperformed. Tesla has pulled ahead in the third quarter.

Source: Fiscal.ai

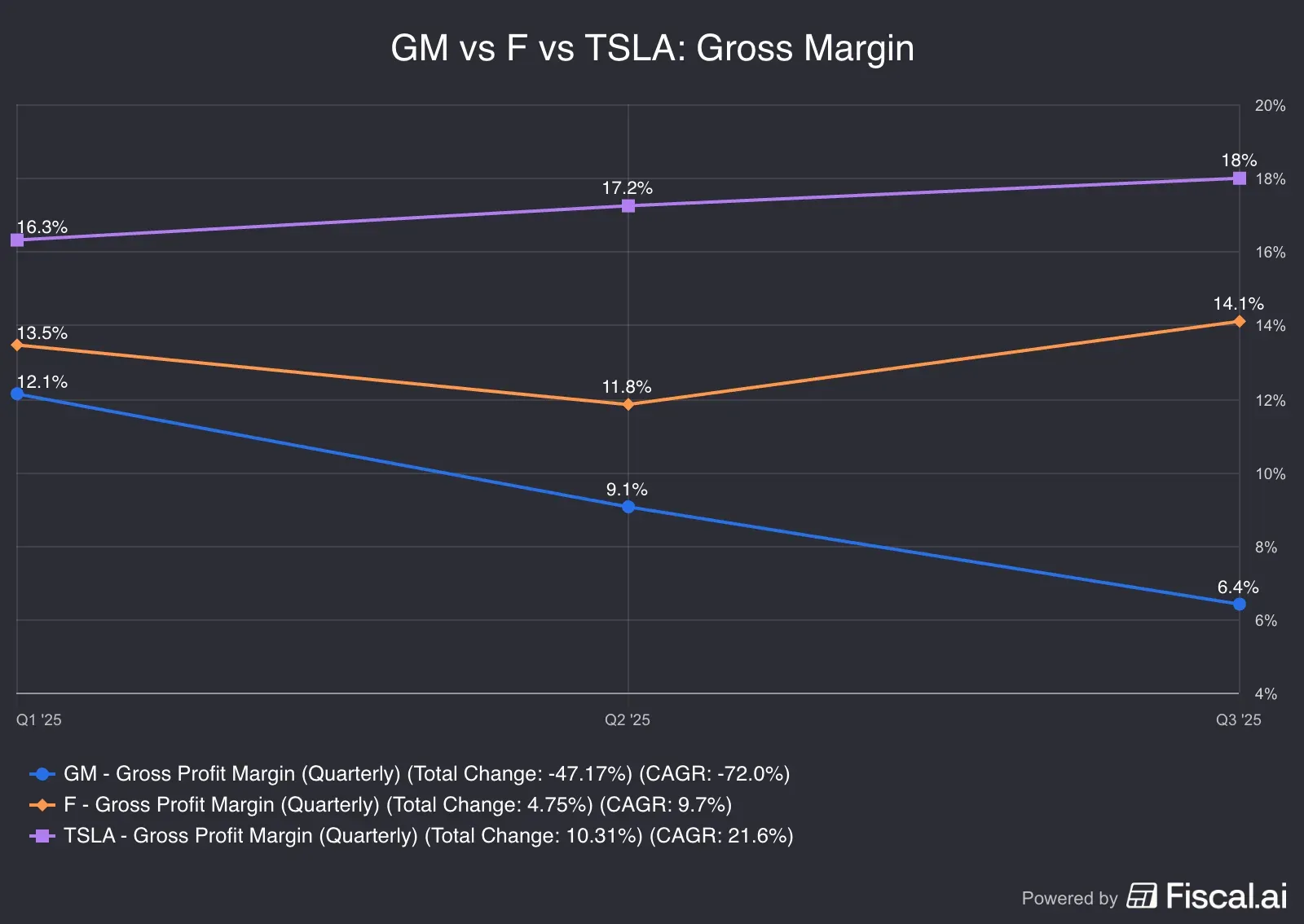

Tesla’s gross margin flatlined but it still exceeded that of Ford and GM.

Source: Fiscal.ai

As part of efforts to shore up its margin and liquidity, Ford announced on Monday that it is shifting focus to higher-return opportunities, such as trucks and vans, by leveraging its manufacturing footprint, while stepping back from select larger EVs due to lower-than-expected demand, high costs, and regulatory changes. The Trump administration’s decision to roll back EV credits has made pricier EVs less affordable for consumers, who are already facing macroeconomic and geopolitical challenges.

In a note released earlier this month, Morgan Stanley analyst Andrew Percoco upgraded GM to ‘Overweight’ and upped the price target to $90 from $54. He, on the other hand, downgraded Tesla to ‘Equal Weight’ from ‘Overweight’ but upped the price target to $425 from $410.

Percoco’s optimistic view regarding GM is premised on his expectations that the ‘EV winter’ will sustain through 2026. The analyst holds a moderately more positive outlook on ICE/hybrid. He, however, has a more cautious outlook on the auto industry, heading into 2026, after the surprisingly resilient 2025. Citing affordability concerns, tightened credit standards amid subprime concerns, and the trickle-through effects of tariff-related inflation through the first quarter of 2026, the analyst predicted that auto sales would decline 10% to a seasonally adjusted annual rate of 15.9 million units in 2026.

On tariffs, the analyst sees the impact tapering off over the next year:

“Tariffs are expected to be roughly neutral YoY in 2026, with an extra quarter of tariff expense offset by higher parts rebates, go- to-market strategies, and cost reductions, though upside could emerge if trade negotiations progress; pricing power should remain limited given industry fragmentation and affordability constraints.”

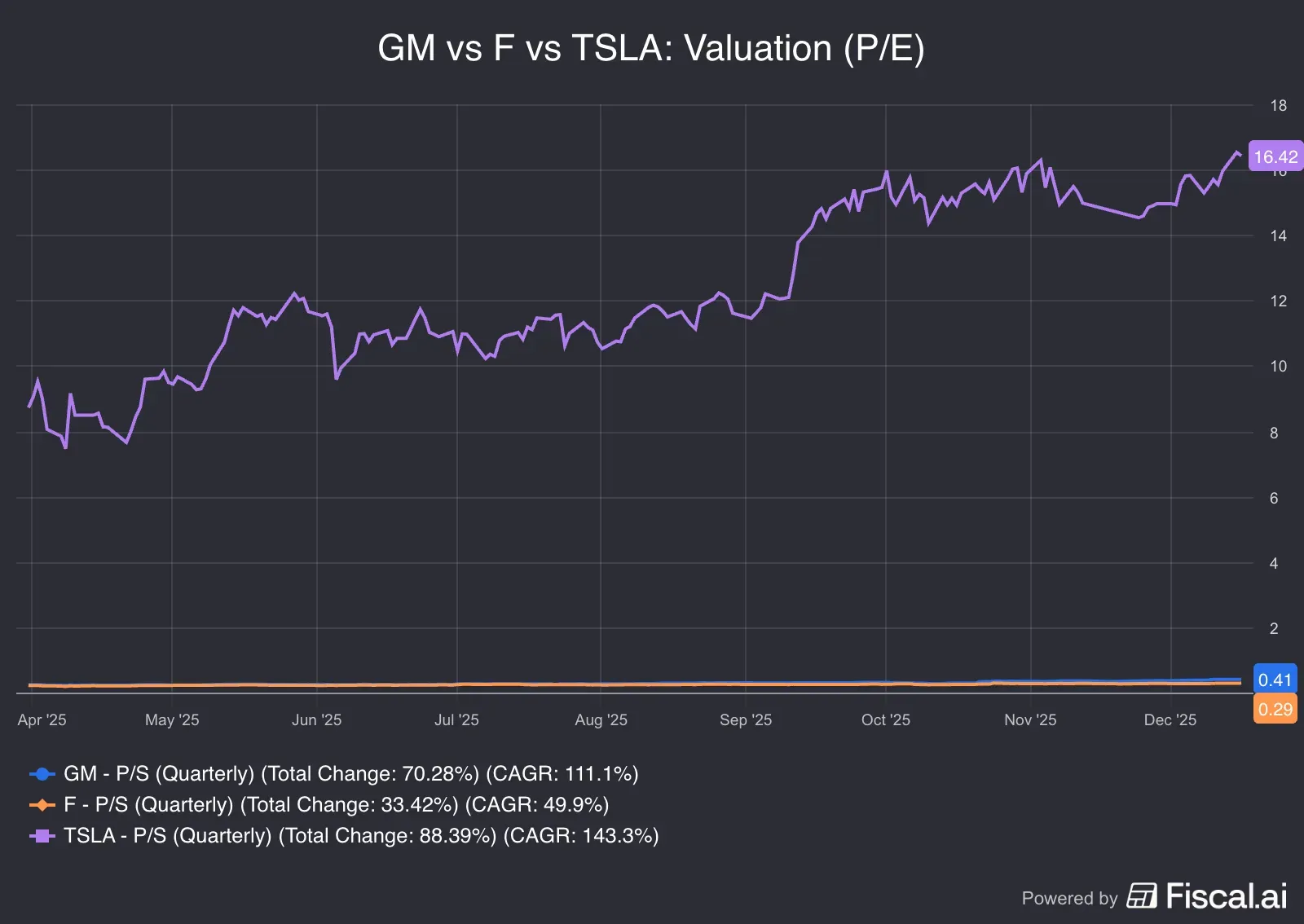

Tesla’s valuation, measured by the price-earnings (P/E) multiple and price-sales (P/S) ratio, shows it is the priciest relative to GM and Ford.

How Retail Traders View GM, Ford

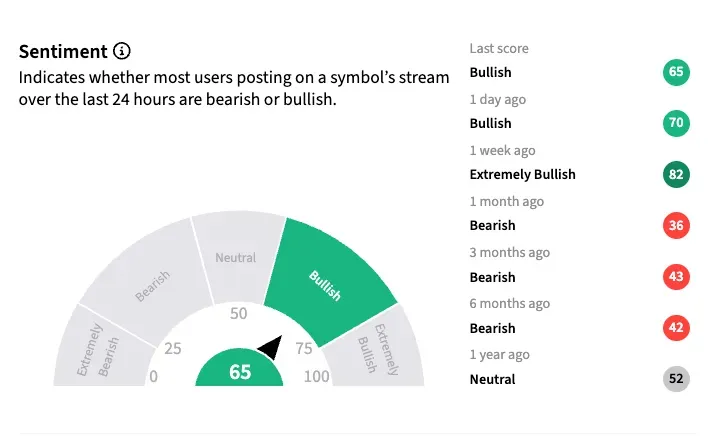

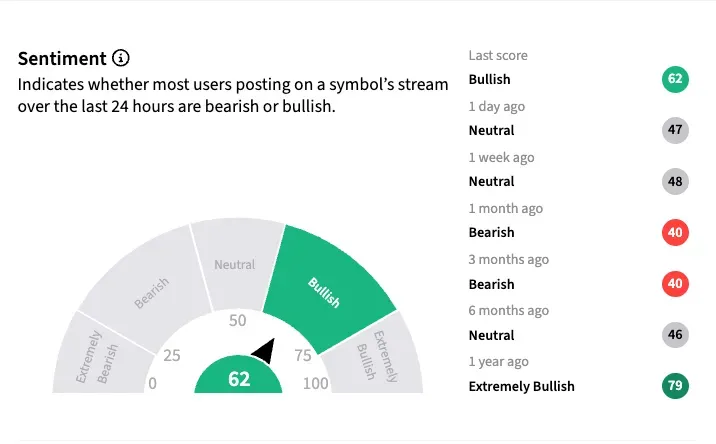

Retail sentiment toward GM and Ford was ‘bullish’ as of early Tuesday, on Stocktwits. While GM continued to elicit an upbeat mood, the sentiment toward Ford increased following the company’s decision to scale back EV plans.

GM followers’ count on the platform has risen by 3% over the past year, while the one-year message count has increased by 440%.

GM - Retail Sentiment

Ford - Retail Sentiment

Tesla’s progress with robotaxis, which is touted as the company’s key flywheel, has sent sentiment toward the stock soaring to ‘extremely bullish’ levels. Rivian’s Autonomy & AI event, which triggered a late stock reaction, has helped lift sentiment into the ‘extremely bullish’ zone.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)