Advertisement|Remove ads.

The Best AI Trades Of The Year Weren’t Nvidia Or AMD — They Were 2 Old-School Storage Giants

- After a brutal 2023 slump, an unprecedented surge in AI compute and data storage needs sparked a massive turnaround for both companies.

- Seagate leads with faster HAMR adoption and multi-year demand visibility, while Western Digital restructures and leans on pricing power despite tech delays.

- Analysts stay bullish, yet warn that storage stocks remain cyclical and vulnerable if AI spending expectations cool in 2025.

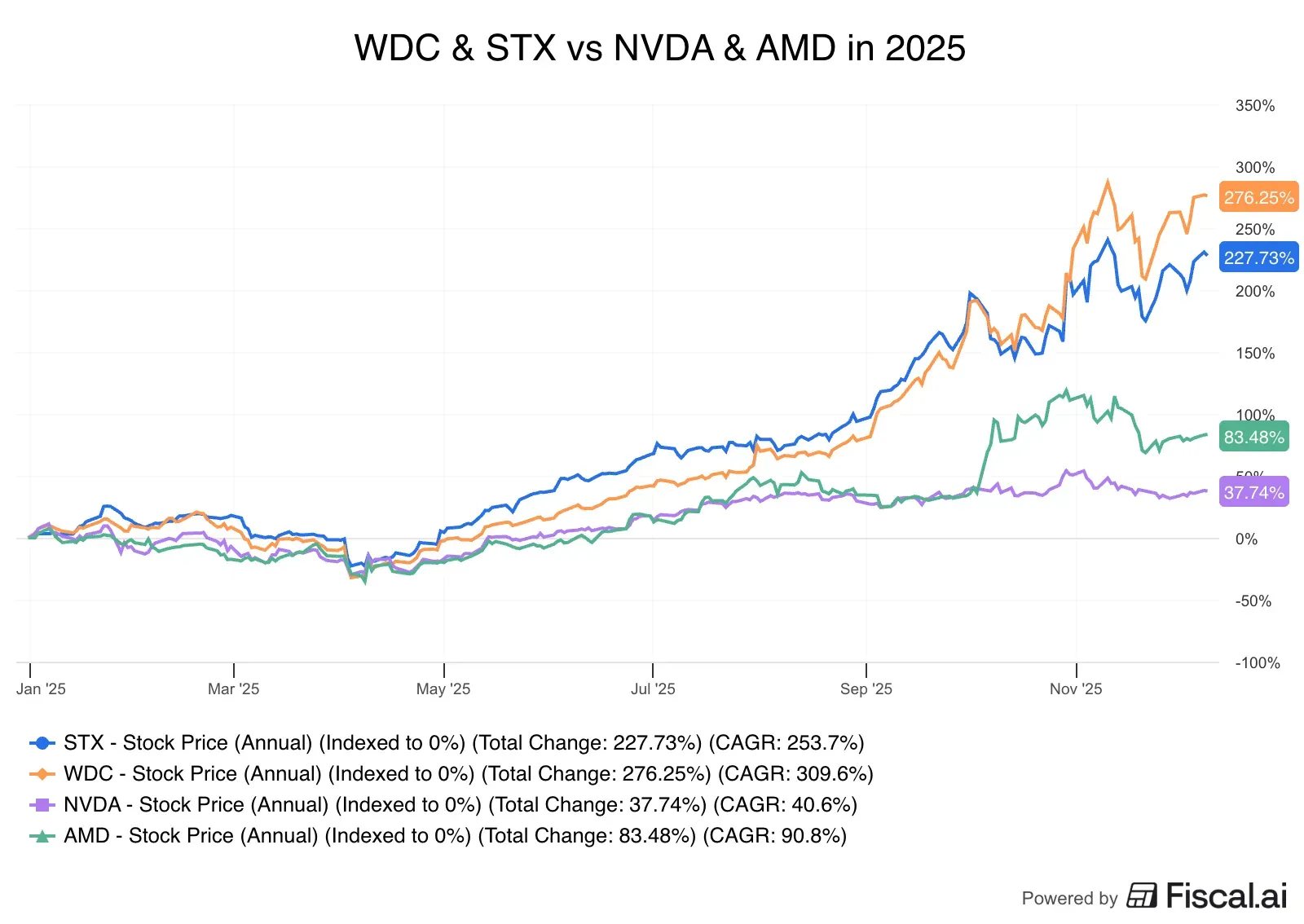

While Wall Street’s attention remained fixated on artificial intelligence (AI) high-flyers and mega-cap techs such as Nvidia and AMD, two under-the-radar stocks quietly emerged as the S&P 500’s strongest performers this year. Legacy storage specialists Western Digital (WDC) and Seagate Technology (STX) have reshaped their businesses, transitioning from traditional hardware roots to models aligned with today’s cloud-driven, AI-centric era.

With less than three weeks left in the year, both STX and WDC have rewarded investors handsomely, each delivering gains of more than 200%. Here’s what fueled their remarkable run — and how the risk-reward equation stacks up from here.

The Great AI Compute Boom

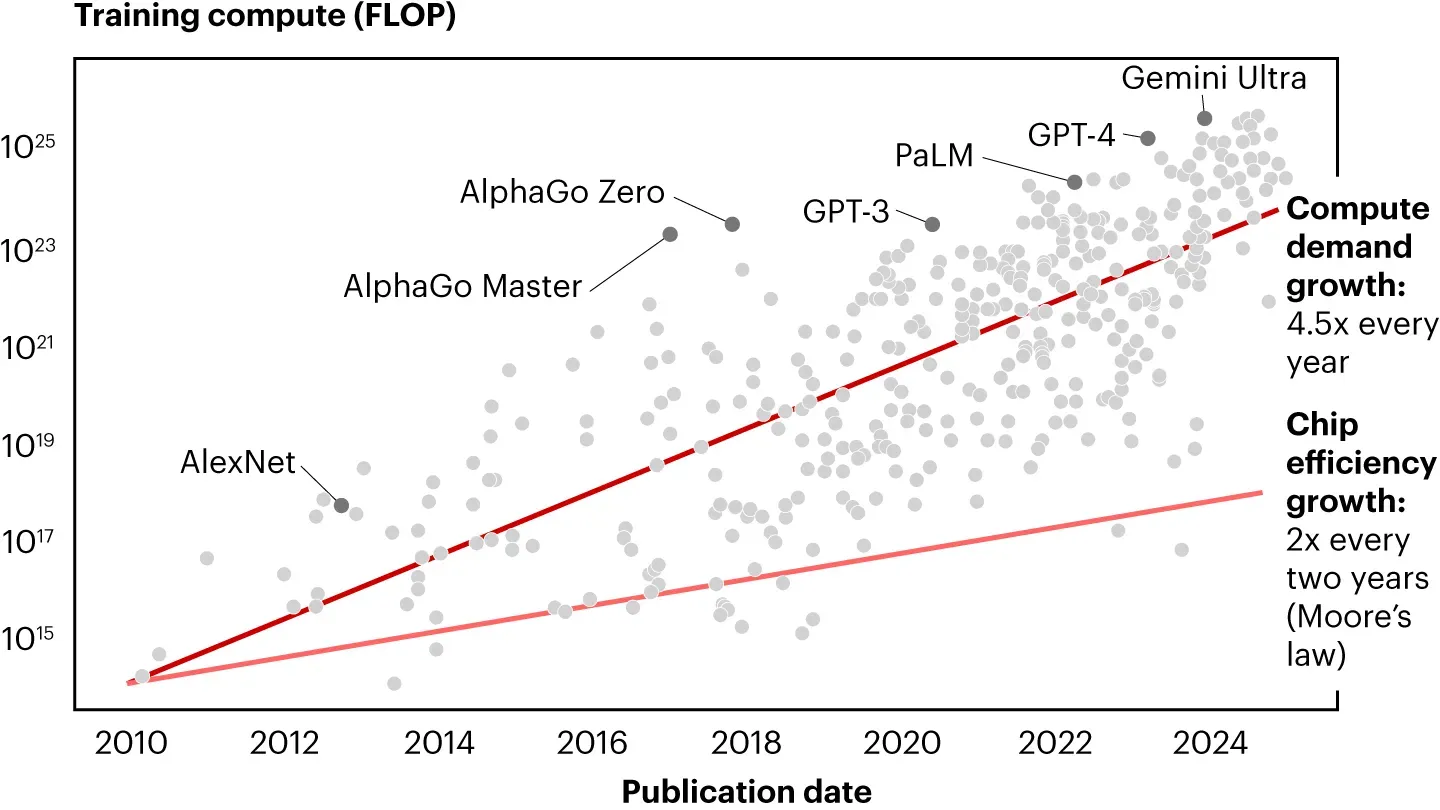

The success of these firms has a lot to do with the explosion of AI compute demand, which has defied Moore’s law, which states that the number of transistors on a microchip doubles approximately every two years, leading to exponential growth in computing power, smaller devices, and reduced costs.

According to Bain & Company, AI’s computational needs are now growing at more than double the pace of Moore’s law. The firm estimates that global compute demand could reach 200 gigawatts by 2030, with the U.S. alone accounting for half of that.

So what does this imply for Western Digital and Seagate? Their core business — mass-capacity data storage — has become essential infrastructure for storing both the vast training datasets behind AI models and the growing avalanche of data produced by AI-driven workloads.

The AI Lifeline

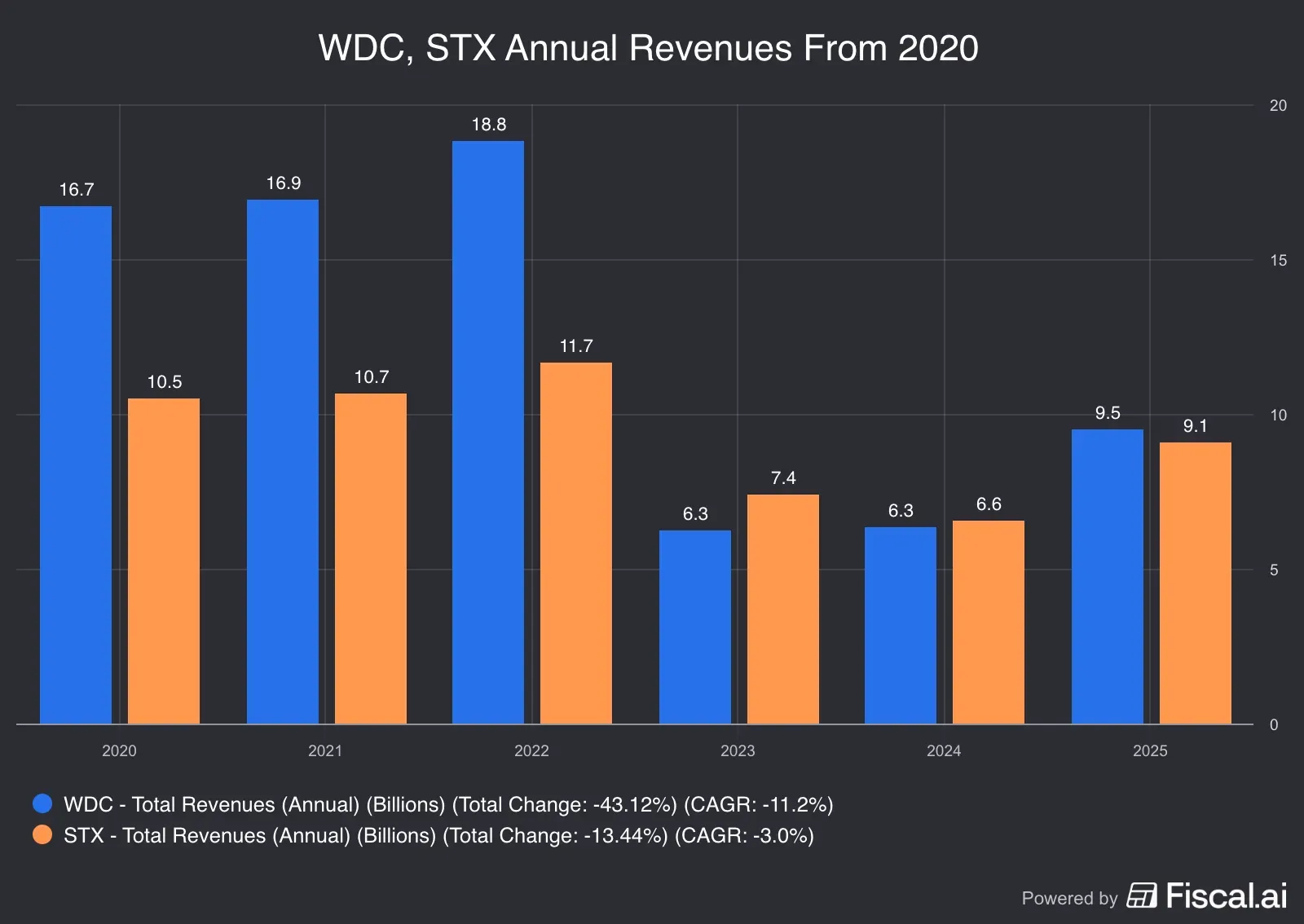

The data center boom came as a lifeline for legacy hardware suppliers facing one of their worst challenges. The top lines of these companies took a nosedive in 2023, as hyperscalers and data center operators, which had bulk-purchased hard disk drives (HDDs) during the COVID-19 pandemic and the post-pandemic growth boom, underwent an aggressive inventory digestion. That has resulted in a massive slowdown in orders, impacting these companies' revenues. The supply glut also dented the average selling prices of HDD and flash drives. It was then that the AI era dawned, and storage companies quickly pivoted to latch onto the opportunity.

Western Digital's Great Reboot

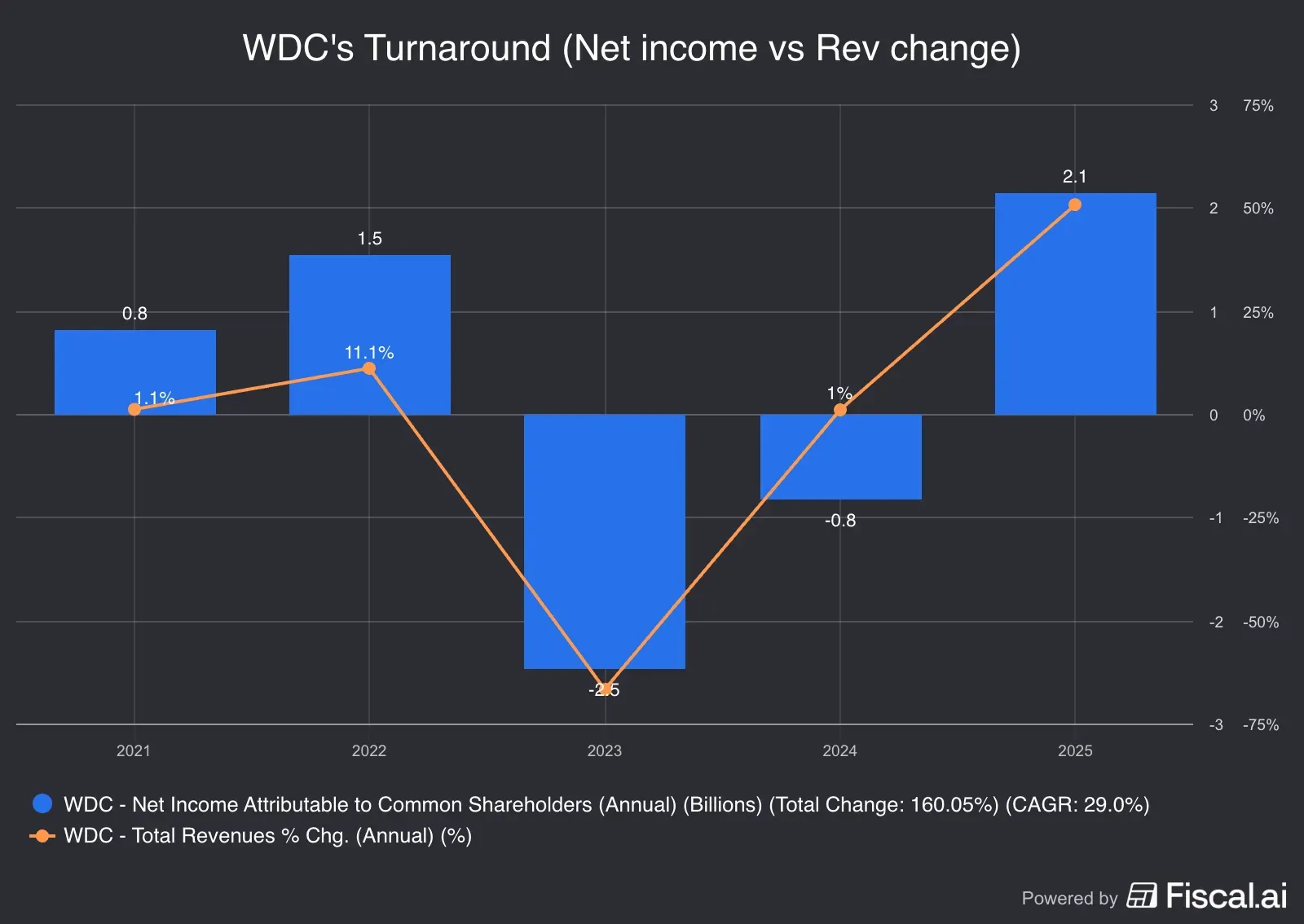

The San Jose, California-based company has put its best foot forward to thrive in a high-demand environment by spinning off its flash business, creating a more focused HDD company. The company has done well to turn around from the steep losses it incurred in 2023 and 2024.

In a note reviewing the company’s September quarter results, Baird analyst Tristan Gerra commended the company for relying on higher-degree migrations to meet the demand for exabytes (EB), a unit of storage, rather than increasing capacity.

Gerra, however, sees risks arising from Western Digital's delay in embracing Heat-Assisted Magnetic Recording (HAMR), a cutting-edge HDD technology that uses a laser to heat tiny spots on a disk, enabling denser data storage. Initial production is expected only in the second half of 2027.

Morgan Stanley’s Erik Woodring, who has an ‘Overweight’ rating and $188 price target for WDC’s stock, bases his bullish stance on “accelerating data growth, which drives storage demand in the cloud and on-prem.

”We believe that we are still in the middle of the cycle upturn – demand outstrips supply with continued upward pressure in HDD pricing – and entering a period of AI-driven storage demand growth, which will benefit both HDDs and SSDs shipments.”

Seagate Tech Leads

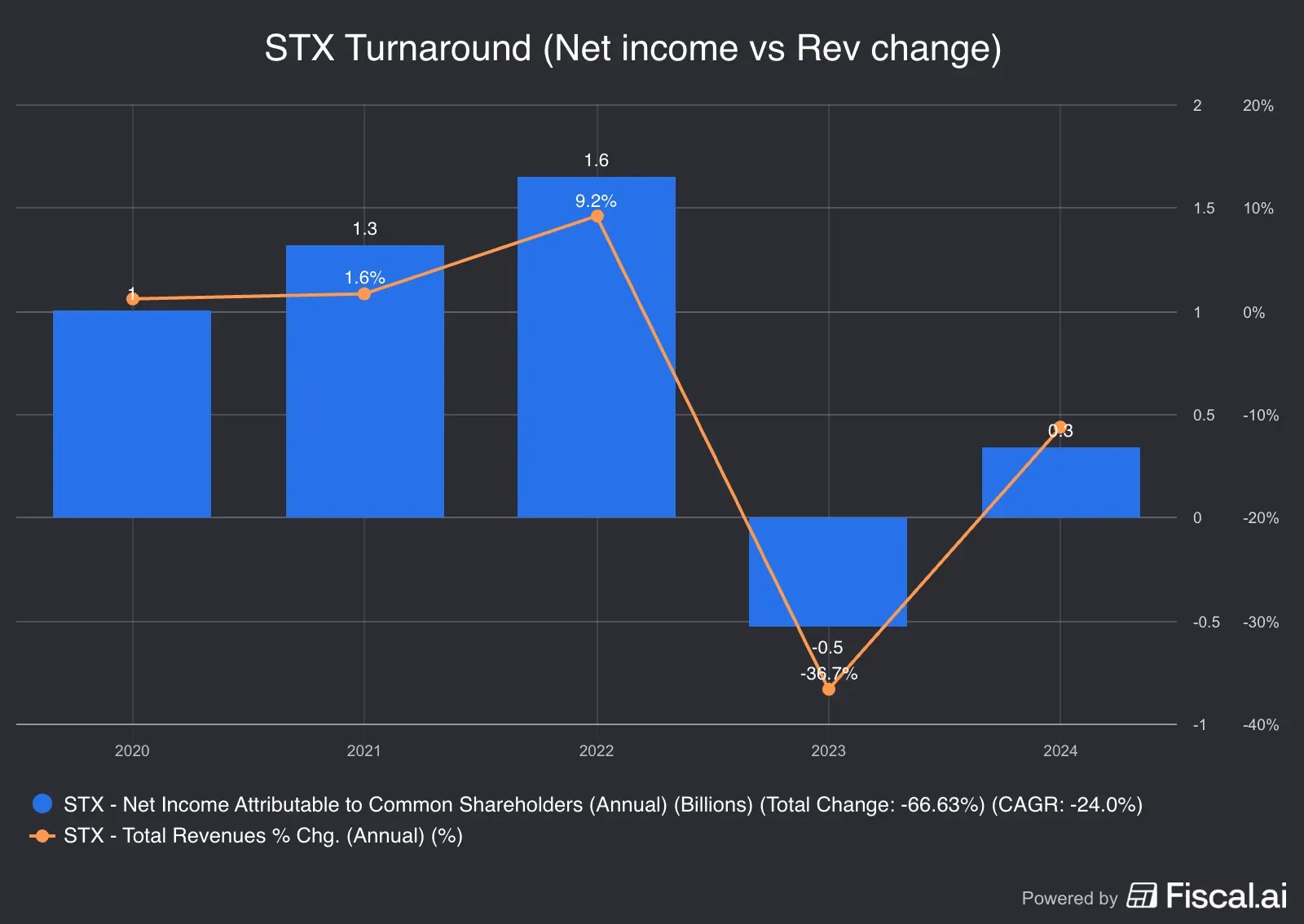

Like its peer, Seagate’s fundamentals have also improved.

The management sounded upbeat in the company’s latest earnings call, stating that HDD demand is strengthening and AI is “creating demand that was expected but larger and coming faster.” In line with strong demand, the management said nearline HDD capacity is now committed via purchase orders through calendar year 2026, and long-term agreements are in place with data center customers through 2027. Morgan Stanley’s Woodring said this level of visibility has never existed in the market.

“We believe the HDD industry supply discipline has made the industry more profitable, and that HAMR and STX's cost/pricing actions will provide a tailwind to the company's gross margin profile in the long term. Combined with opex discipline, we expect a decent multi-year earnings story ahead.”

Woodring has an ‘Overweight’ rating and $270 price target for STX stock.

Seagate has the technology lead over Western Digital, as its HAMR products ramp up. The transition to Its Mozaic 4 HDD, leveraging HAMR, is progressing faster. The company said five cloud service providers (CSPs) are now using the previous-generation Mozaic 3+ qualification, and three additional CSPs are on track for C1H26, with 50% EB crossover on track for C2H26.

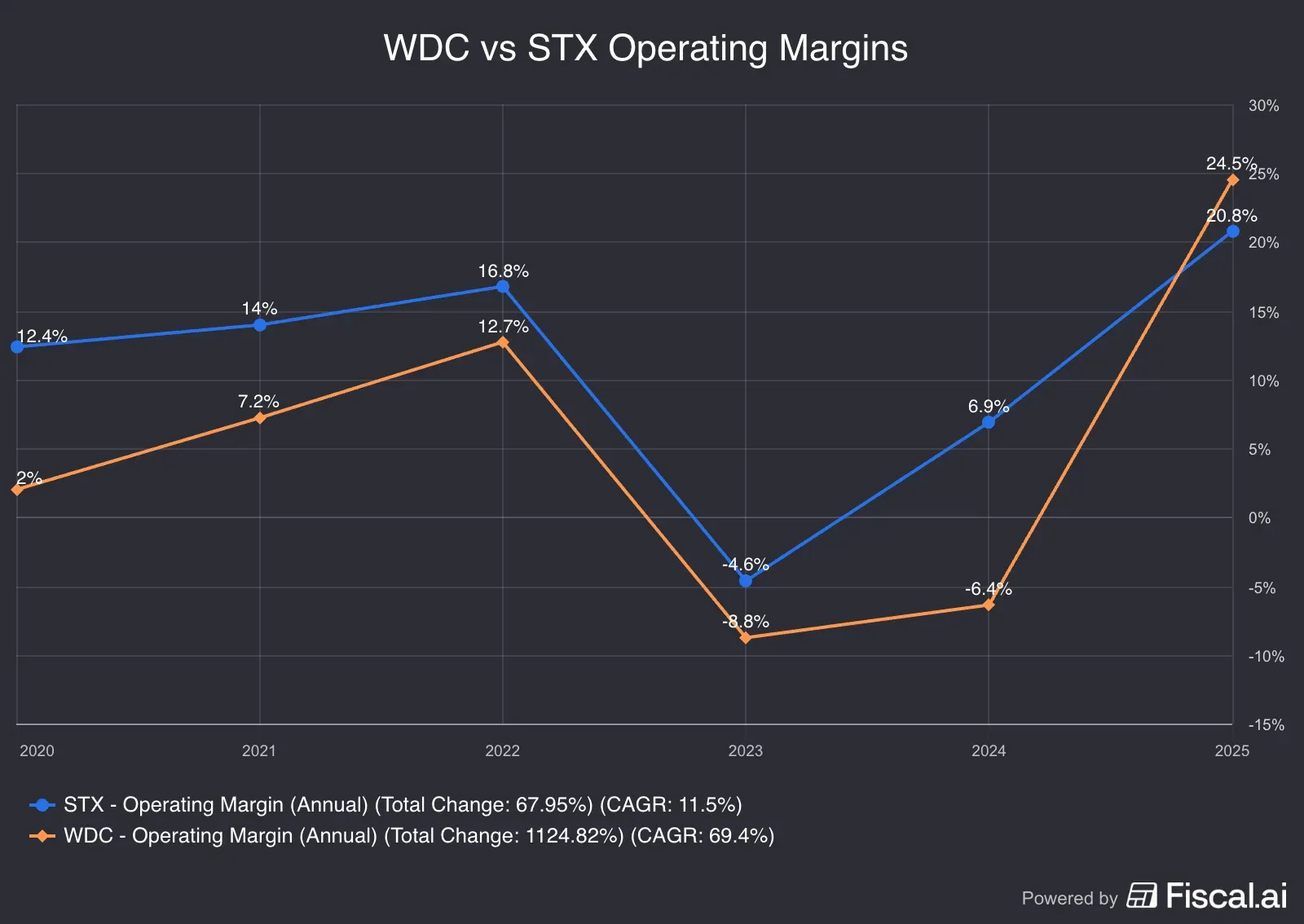

The margin profile of these companies has strongly benefited from the rising share of AI-related storage revenue.

Gianlica Romano, CFO of Seagate, attributed the record adjusted gross margin to increased adoption of its latest-generation products and the ongoing execution of its pricing strategy.

The Stock Trajectory

Is It Too Late To Jump On The Storage Bandwagon?

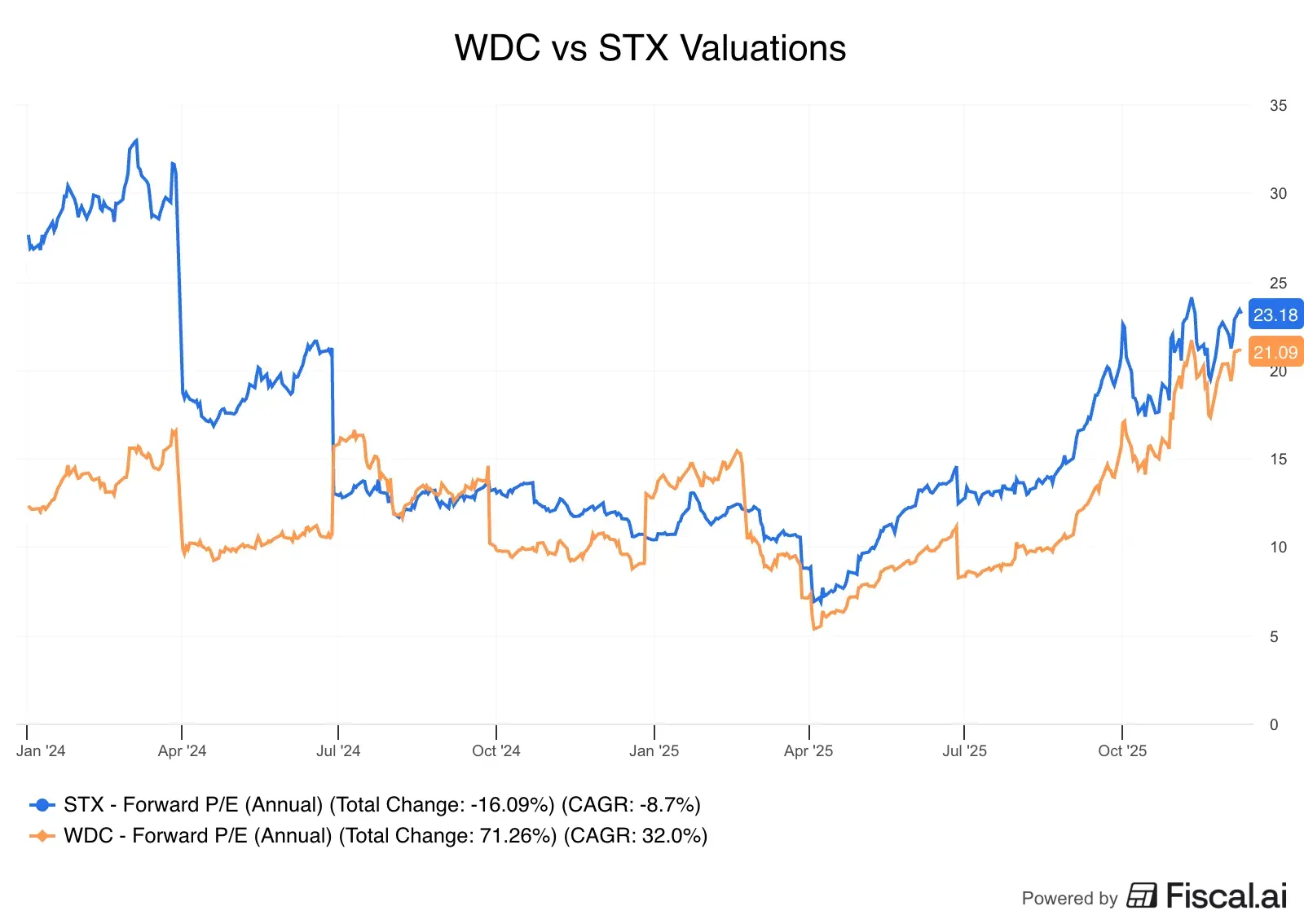

Despite the meteoric rise this year, the forward price-earnings (P/E) multiples of WDC and STX are roughly in line with the information technology industry’s 28.2 times.

Lloyd Financial Chief Investment Officer Colin Symons lamented that the firm didn’t hold on to its STX holding for long. “LFG owned STX and rode the wave until near $200 from $100.. Wish we would've held it longer, but it was one of our best performers this year.”

Symons, while impressed with how the surging demand is boosting margins and free cash flows, sounded a warning. “As long as we get growth in AI intentions, the story can have legs, but once that story slows, these are cyclical companies that can fall fast. When is that likely? I'd bet at some point next year, probably towards the front half.”

The strategist noted that market estimates put the storage industry’s total addressable market (TAM) at $200 billion, growing at 14%, and the data center market opportunity at $500 billion+. “Data centers may require almost $7T in spending, with storage being a big part, so you can make a growth story here,” he said,

“Basically, as long as the AI story remains intact, these guys should do well. However, the numbers already seem questionable ($7T in spending) so expectations are already awfully high. We can go higher, but disappointment would hurt quite a bit.'

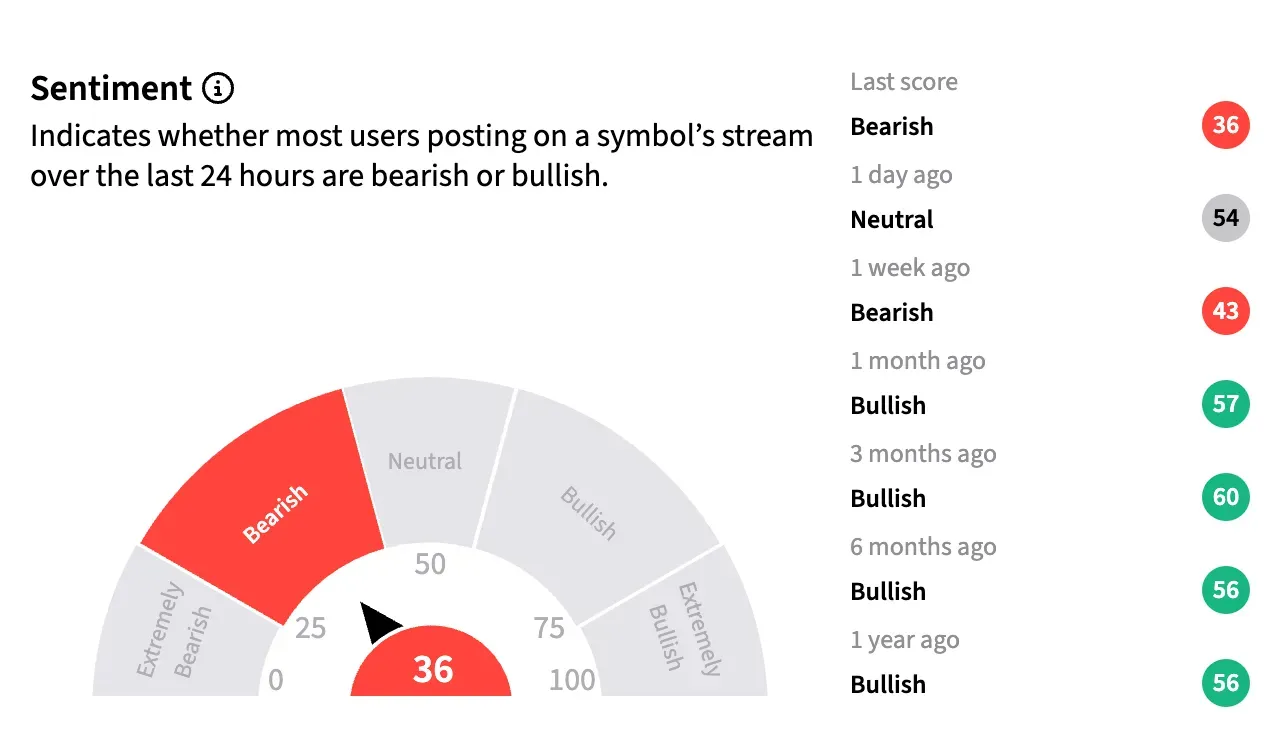

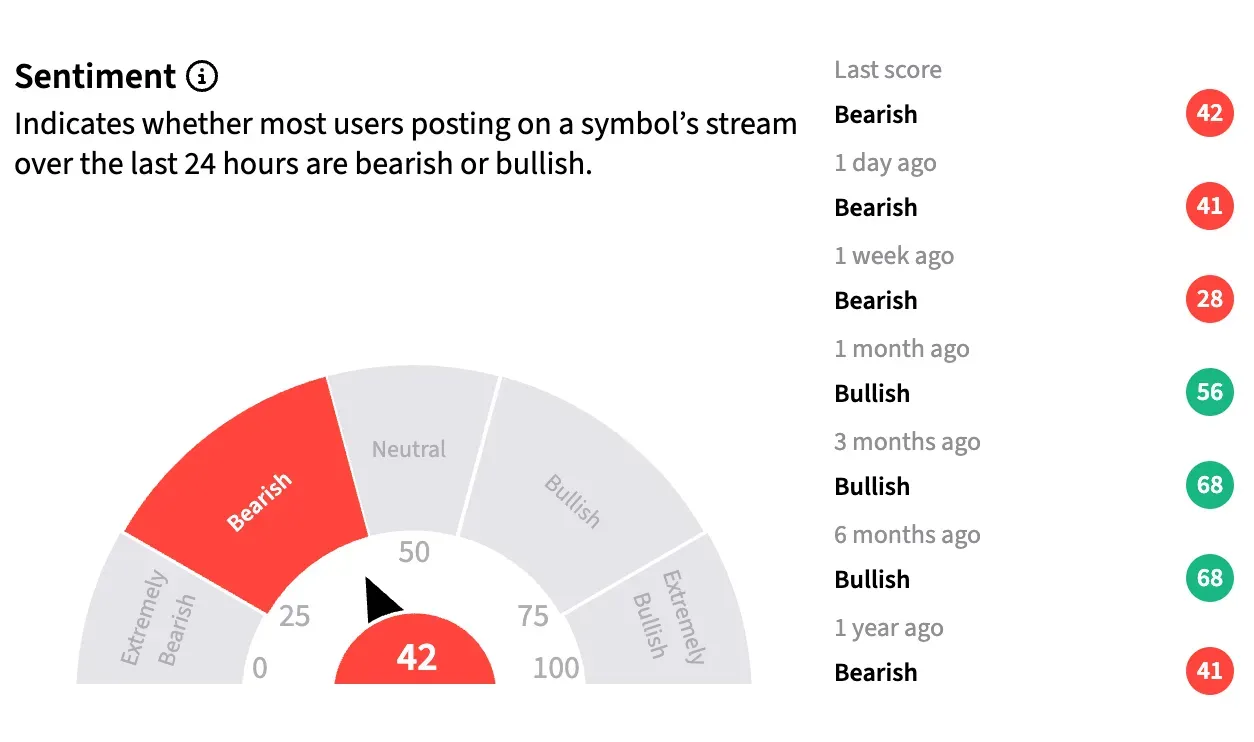

Retail sentiment toward these stocks has soured in the past month amid the market downturn. On Stocktwits, retail sentiment toward Seagate has shifted to ‘bearish’ from a mostly ‘bullish’ sentiment seen for much of the year.

Sentiment toward the WDC stock has been in ‘bearish’ terrain over the past month, after remaining bullish for much of the past six months.

According to Koyfin, the average analysts’ 12-month price targets for Western Digital and Seagate are $181.43 and $289.24, respectively. The consensus price targets imply upside potential of 7% for WDC and 2% for Seagate.

Of the 26 covering WDC stock, 21 rate it a ‘Buy’ or ‘Strong Buy’, and five have ‘Hold’ ratings. Twenty-four analysts cover STX, and 17 of them rate it a ‘Buy’ or a ‘Strong Buy.’ Six remain on the sidelines, and one has a ‘Sell’ rating.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263711678_jpg_7dcbe85e4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202237165_jpg_188d67bdb5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_2_jpg_0c6789db95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263736058_jpg_2b8f901978.webp)