Advertisement|Remove ads.

HSBC Stock Slides 6% Premarket After $14B Offer To Buy Remaining Stake In Hong Kong Unit

HSBC's U.S. shares fell nearly 6% in premarket trading on Thursday after the lender agreed to wholly buy out its Hong Kong-based unit, Hang Seng Bank, for almost $14 billion.

The London-based bank is offering 155 Hong Kong dollars for each share of the Hang Seng Bank, representing a 33% premium over the undisturbed 30-day average closing price. HSBC already holds about 63% of the bank, and the offer price values Hang Seng at $37 billion.

"This proposal fully meets our criteria for value-accretive investments: it aligns with our strategy, enhances growth and scale, does not distract us from organic growth, and delivers greater shareholder value than buybacks," HSBC CEO Georges Elhedery said.

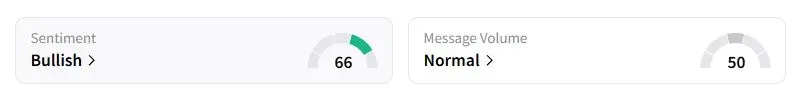

Retail sentiment about HSBC on Stocktwits was in the 'bullish' territory at the time of writing.

HSBC said it expects to restore its CET1 ratio to its target operating range of 14.0%-14.5% through a combination of organic capital generation and not initiating any further buybacks for three quarters.

Michael Makdad, Morningstar's senior equity analyst, said that the acquisition, the largest in Hong Kong in over a decade, was a positive move by the bank, as it will help it resolve inherent governance issues associated with parent-subsidiary double listings.

While Hong Kong has seen a resurgence in the IPO market this year, primarily led by firms from Mainland China, the city's banking sector is still reeling under pressure from the most severe real estate downturn since the late 1990s Asian financial crisis. There have been talks establishing a "bad bank" to acquire these non-performing loans, which Fitch Ratings estimates total approximately $25 billion.

HSBC itself is undergoing an overhaul under Elhedery, who has pledged to reorganize the bank into four new divisions and exit some businesses in a strategic reset. HSBC has also, over the past years, pivoted to Asia, closing and selling off businesses across Europe and North America.

HSBC's U.S. shares have gained nearly 47% this year.

Also See: AZZ Stock Tumbles 6% Premarket After Q2 Earnings: What Went Wrong?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2237643016_jpg_17a9a7eb9d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221557373_jpg_2cb3ed82cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2251311021_jpg_31a407e714.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aluminum_resized_jpg_6efa759339.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)