Advertisement|Remove ads.

AZZ Stock Tumbles 6% Premarket After Q2 Earnings: What Went Wrong?

AZZ Inc. (AZZ) stock fell nearly 6% premarket on Thursday after the company’s fiscal second-quarter earnings came in below Wall Street’s estimates.

The metals coating producer reported adjusted earnings of $1.55 per share for the second quarter, compared with market estimates of $1.57 per share, according to Fiscal.ai data. AZZ’s second-quarter sales of $417.3 million also missed expectations of $429.4 million.

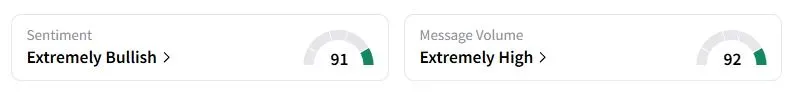

Retail sentiment on Stocktwits about AZZ was in the ‘extremely bullish’ territory at the time of writing.

"In line with broader industry trends, Precoat Metals' sales results were pressured by building construction, HVAC, and appliance end-markets,” said CEO Tom Ferguson in a statement.

U.S. manufacturing rose for a fourth successive month in September, but the upturn lost momentum as companies reported a drop in order book growth alongside a buildup of unsold finished goods inventories, according to S&P Global data.

Its fiscal second-quarter net sales in the metal coatings segment increased by 10.8% to $190 million over the same period last year, primarily due to higher volume supported by infrastructure-related project spending in several end markets. However, its adjusted core profit margin declined.

The company maintained its full-year sales forecast, which is in the range of $5.75 to $6.25 per share, along with sales projections of $1.63 billion and $1.73 billion.

Many retail traders were optimistic that the stock would recover from the dip.

AZZ stock has gained 28% this year, bettering the 15% gain of the benchmark S&P 500 index.

Also See: Why Is Richardson Electronics Stock Rising Over 16% Premarket Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)