Advertisement|Remove ads.

HubSpot Analyst Slashes Stock Price Target By Over 20% On Choppy H1 View, But Retail Stays Upbeat

Shares of customer relationship management platform HubSpot, Inc. (HUBS) could be in the spotlight after Jefferies analysts cut the price target for the stock by more than 20%.

Jefferies analyst Samad Samana lowered the price target for HubSpot stock to $700 from $900 but maintained a ‘Buy’ rating, The Fly reported.

Even with the reduced price target, the stock still presents an upside potential of about 33% from the tariff-ravaged levels.

Jefferies’ recent partner feedback, job listings data, and readthroughs from other companies suggest the first half of 2025 may be choppy for HubSpot. This is especially so as the uncertainty has been steadily increasing for businesses of all sizes since the middle of the March quarter, it added.

Earlier this month, Morgan Stanley analyst Elizabeth Porter said HubSpot is among the small and medium businesses (SMB)-focused software-as-a-service (SaaS) names that has the potential to weather the ongoing macroeconomic uncertainties.

Macquarie analyst Steve Koenig initiated the stock with an ‘Outperform’ rating and a $730 price target in late March. The analyst highlighted HubSpot’s competitive differentiation based on its unified marketing, selling, service, and commerce capabilities for the two to 2,000-employee segment.

Last week, at the Spring 2025 Spotlight event, the company launched new and enhanced artificial intelligence (AI) agents and over 200 updates.

Andy Pitre, EVP of Product at HubSpot said, "We've embedded AI throughout our entire platform so businesses of any size can start seeing value immediately, without massive teams or budgets."

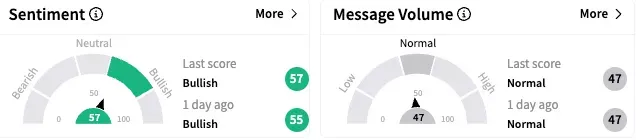

On Stocktwits, retail sentiment toward HubSpot stock remained ‘bullish’ (57/100), although the message volume stayed ‘normal.’

HubSpot stock ended Monday’s session marginally lower at $527.56, taking its year-to-losses to over 24%. The Koyfin-compiled consensus price target for the stock is $826.56.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)