Advertisement|Remove ads.

IBM’s Stock Hits Record High As Retail Traders Cheer Trade Secrets Lawsuit Win

Shares of International Business Machines Corp. (IBM) surged to an all-time high of $266.45 after the company secured a legal victory in the U.K. against U.S. tech entrepreneur John Moores and his firm, LzLabs, over allegations of trade secret theft.

According to Reuters, IBM accused LzLabs' U.K. subsidiary, Winsopia, of purchasing an IBM mainframe computer and agreeing to a license in 2013, only to use that access to reverse engineer IBM’s proprietary mainframe software.

The report said LzLabs and Moores argued they had developed their software over nearly a decade and had not illegally used IBM’s technology.

The High Court essentially ruled in IBM’s favor. In a written decision, Judge Finola O’Farrell found that Winsopia had breached its IBM software license agreement and that "LzLabs and Mr. Moores unlawfully procured those breaches."

However, the report added that IBM’s case against another British subsidiary of LzLabs and its current and former CEOs was dismissed.

"IBM is delighted that the court has upheld our claims against Winsopia, LzLabs GmbH, and John Moores," the company said.

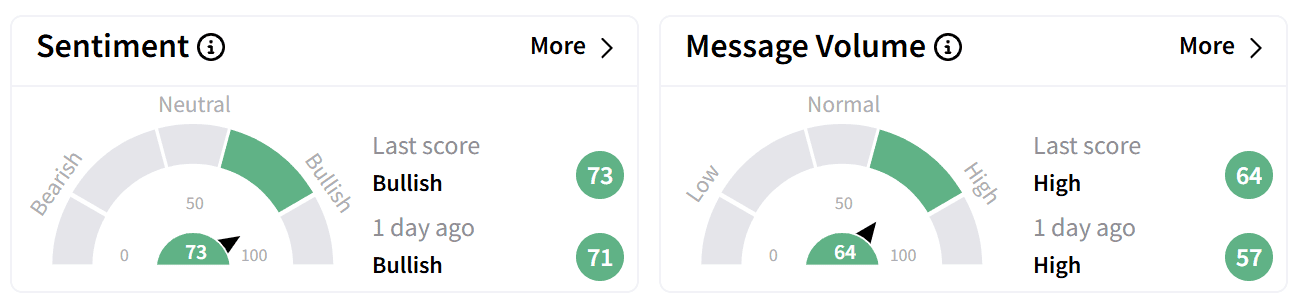

On Stocktwits, retail sentiment around IBM's stock ticked higher in the ‘bullish’ zone, accompanied by ‘high’ levels of chatter.

Users on the platform were pleased with IBM’s performance amid the broader market slump.

China's newly imposed tariffs on U.S. agricultural products and President Donald Trump's bearish comments added to market uncertainty on Monday.

"I hate to predict things like that," Trump told Fox News, adding that the U.S. was in a "period of transition" due to his administration's sweeping economic changes.

Despite an early rally, IBM edged down 0.3% in midday trading on Monday. The stock remains up 33% over the past year and has gained 17% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)