Advertisement|Remove ads.

Icahn Enterprises’ Stock Plunges 12% As Firm Looks To Raise $400 Million Through Share Sale: What’s Retail Thinking?

Shares of Icahn Enterprises (IEP) plunged over 12% on Monday after the company notified it intends to raise $400 million through issue of depositary units through an at the market offering.

IEP said it intends to use the net proceeds from the issue to fund potential acquisitions and for general limited partnership purposes. Jefferies has been signed up to act as the agent for the transaction.

In May, the firm, along with Icahn Enterprises Finance Corp, announced the closing of their $750 million 9% senior unsecured notes offering in a private placement. The funds were used to retire the firms’ existing debt.

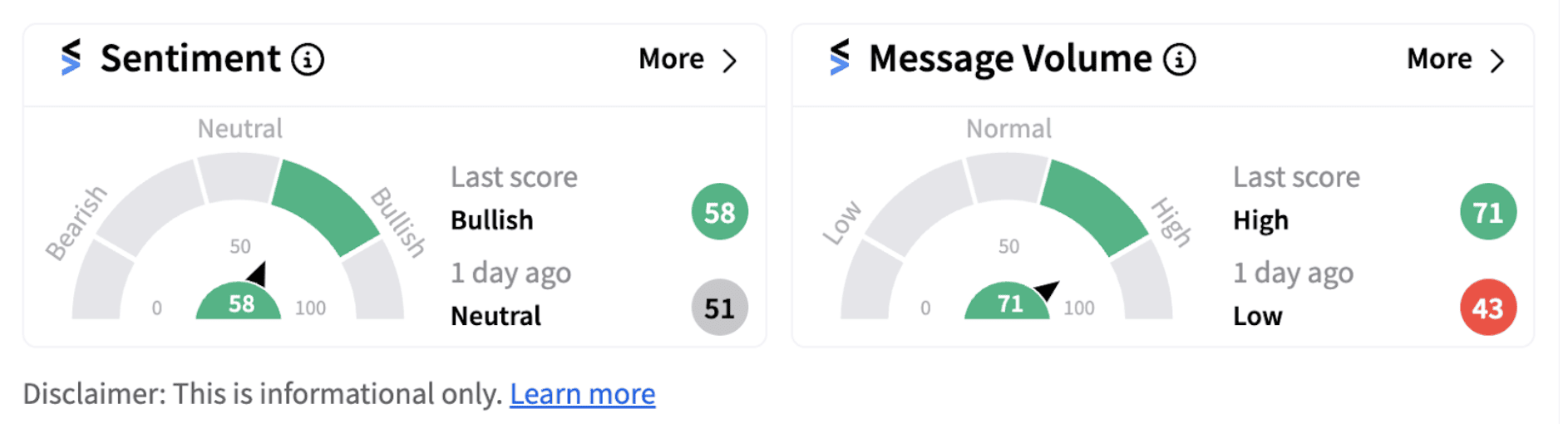

Despite Wall Street pessimism, retail sentiment on Stocktwits entered ‘bullish’ territory (58/100) from the ‘neutral’ zone a day ago.

Last week, the Securities and Exchange Commission (SEC) announced charges against IEP and its founder and activist investor Carl Icahn. The charges were leveled for failing to disclose information relating to Icahn’s pledges of IEP securities as collateral to secure personal margin loans worth billions of dollars under agreements with various lenders.

The regulator said IEP and Icahn have agreed to pay $1.5 million and $500,000 in civil penalties, respectively, to settle the charges.

From at least Dec. 31, 2018, through the present, Icahn pledged approximately 51% to 82% of the firm’s outstanding securities as collateral to secure personal margin loans worth billions of dollars under agreements with various lenders.

IEP and Icahn have agreed to cease and desist from future violations and to pay the civil penalties without admitting or denying the findings.

Shares of the company have lost over 20% so far this year. Stocktwits users believe the shares appear to have been oversold in the wake of the slew of negative news and might see a rebound going into the third-quarter earnings. Indeed, the stock’s relative strength index (RSI) is currently trending near the 27-mark, implying the market is beginning to consider the current levels as attractive.

See Also: Morgan Stanley Raises Chewy’s Price Target To $30: Is Retail Happy?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitdeer_0adcf9a760.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254687746_jpg_9f8228b6ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cfpb_resized_png_ad08d8de38.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_52154609_jpg_bc5ad676b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Musk_Space_X_jpg_28cee07c59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_jpg_7ed87bb07c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)