Advertisement|Remove ads.

IMAX Gains Ground On Record Year Target As Blockbusters Reportedly Drive Market Share Surge – Retail Echoes Confidence

IMAX Corp. (IMAX) is reportedly expected to hit its highest annual performance yet, driven by strong ticket sales, increasing appetite for high-end cinema experiences, and a broad international growth plan.

According to a CNBC report, premium-format theaters have played a major role in boosting the company’s share of the box office. It noted that Apple Inc.’s (AAPL) ‘F1: The Movie’ brought in close to $300 million worldwide within its first 10 days, with more than 20% of that total coming from IMAX showings.

Following the report, IMAX stock traded 2.6% higher on Friday afternoon.

The report added that, in the U.S. and Canada, IMAX venues generated 25% of the film’s domestic revenue, despite making up less than 1% of all movie screens globally. Major releases are increasingly opting for IMAX presentation, with titles like Warner Bros' ‘Sinners’ and Paramount’s ‘Mission: Impossible – The Final Reckoning’ earning over 20% of their total revenue from IMAX showings.

It said the format’s enhanced visuals and custom camera technology have helped draw larger audiences and higher ticket revenue.

The company’s CEO, Rich Gelfond, highlighted that eight films in a row were shot using IMAX cameras, emphasizing that more filmmakers are endorsing the format.

IMAX currently operates around 1,700 screens, with about 400 in North America, and has deals in place to install 500 additional theaters worldwide, the report stated.

In the fourth-quarter (Q4) earnings call, Gelfond projected $1.2 billion in revenue for 2025, a potential all-time high.

In May, the company expanded its collaboration with Regal Cinemas by launching four additional IMAX with Laser theaters in key metropolitan regions across the U.S.

The release calendar through 2026 includes movies such as Disney’s ‘Avatar: Fire and Ash,’ Marvel’s ‘Fantastic Four: First Steps,’ Amazon.com Inc.'s (AMZN) ‘Project Hail Mary’” and new entries in the Star Wars, Toy Story, and Shrek franchises.

Recently, Eric Handler, an analyst at Roth Capital, had said that IMAX’s worldwide box office performance is rebounding strongly and could match or exceed its $1.2 billion forecast for 2025, as per TheFly.

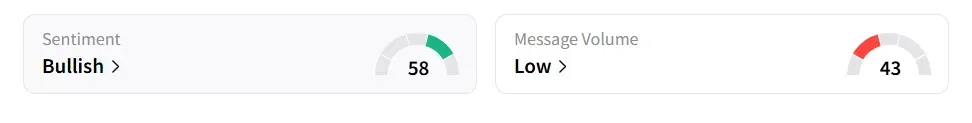

On Stocktwits, retail sentiment toward IMAX jumped to ‘bullish’ from ‘bearish’ territory the previous day.

IMAX stock has gained over 4% in 2025 and over 54% in the last 12 months.

Also See: Microsoft Investors Demand Oversight On AI Use In Gaza, Questioning Human Rights Due Diligence

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)