Advertisement|Remove ads.

India Opportunity Day: Conviction before consensus

At India Opportunity Day, presented by Skycatcher, in association with CNBC-TV18, founders and investors decoded what it takes to build conviction before consensus. Skycatcher invested in Rapido when few believed two-wheelers could be regulated or trusted. Eight years later, it realised part of that investment, redeploying capital into the next wave of founders.

When belief precedes validation, India’s entrepreneurs often find themselves building where the map ends. At India Opportunity Day, presented by Skycatcher, in association with CNBC-TV18, founders and investors decoded what it takes to build conviction before consensus.

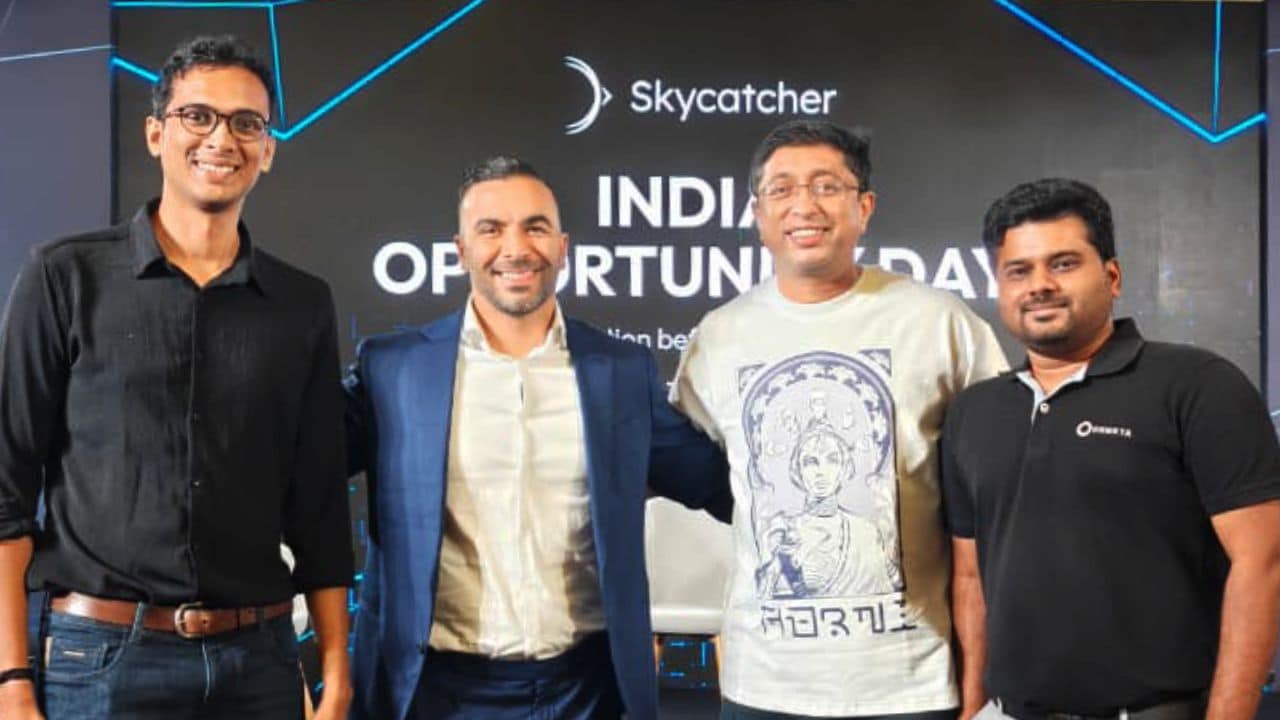

In successive panel discussions at the event, Sia Kamalie, Founder & Managing Partner, Skycatcher; Aravind Sanka, Co-founder of Rapido; Saurav Jain, Principal at Prosus Ventures; Roby John, Co-founder & CEO of SuperGaming and Bharath T, Co-founder & CEO of Onmeta demonstrated the spirit of early conviction.

Riding ahead of the curve

Aravind Sanka’s journey with Rapido began far from the comfort zone of India’s metros. "We didn’t want to build for the top ten million; we wanted to build for the next five hundred million," he said. Originating from a Tier-IV town, Sanka recognised a gap few were addressing — affordability in daily mobility.

While competitors focused on premium city markets, Rapido built its thesis around smaller towns, making two-wheeler taxis affordable, insured and safe. Today, Rapido commands a market share of nearly 90 per cent in Tier-III and IV towns. "Two-wheeler taxis seem obvious now, but when we started, they weren’t," he reflected.

For investor Sia Kamalie, who led Rapido’s $4 million Series A, the contrarian bet was intuitive. Having previously invested in a Bangladeshi ride-sharing startup, Kamalie saw the same early-market signals. "These moments when you can be contrarian are very rare," he noted.

"We wanted someone with conviction, not curiosity." Skycatcher not only led the Series A but also followed on in later rounds, staying committed through Rapido’s scale journey and helping drive the company toward the next stage of growth.

Backing the builders, not the buzz

Sia Kamalie calls Skycatcher an “entrepreneur investor” rather than an institutional fund. “We’re truly all-in,” he said. “We’re not chasing credentials; we’re chasing greatness and we’re not afraid to make mistakes along the way.”

That philosophy has paid off. Skycatcher invested in Rapido when few believed two-wheelers could be regulated or trusted. Eight years later, it realised part of that investment, redeploying capital into the next wave of founders who, as Kamale puts it, could become the ‘Rapido Mafia’; lean, disciplined builders defining India’s cost-efficient innovation DNA.

From players to global publishers

One such bet is SuperGaming, a Pune-based studio proving that India can build global gaming IP. “We’ve built games like MaskGun and Silly Royale, played by over 200 million people across the globe,” said CEO Roby John.

Sia Kamalie, who led SuperGaming’s Series A and B rounds, saw a much bigger play. “Social gaming is a $200 billion market, far larger than real-money gaming,” he said. “If you get the social layer right, you build franchises that last decades.”

John shared that recent regulatory clarity separating real-money from video gaming is a turning point. “For years, we had to keep saying we make video games, not betting products. Now the government has drawn that line giving much-needed clarity to our space.”

What sets SuperGaming apart is their ability to build a game within the battle royale genre which typically requires $100 million in development costs — with just $15 million. This feat is made possible by the studio’s proprietary in-house tech stack that significantly cuts down on external dependency. More importantly, it’s powered by the relentless drive of its co-founders, who’ve been building together for over 15 years.

SuperGaming is also channeling India’s cultural power into a new IP. Partnering with FanCraze, it is set to launch ICC SuperTeam— a community-first social cricket app that celebrates fandom, not fantasy. “Cricket is a culture in India,” John said. “We’re reinventing how fans re-live their favourite moments without touching betting or speculation.”

Building the next financial rails

The conversation closed with Skycatcher’s newest investment — Onmeta, a bridge between the Indian rupee and the crypto economy. "We provide rails that let users access Web3 apps using INR," explained founder Bharath T.

Kamale described Onmeta as part of the same conviction-driven lineage. “Crypto can do what Rapido did for mobility — make it cheaper, faster, and more inclusive,” he said.

Bharath highlighted the regulatory progress since 2022 — taxation rules, FIU monitoring, and a coming national crypto policy. “India should empower users to safely access decentralized apps,” he said. “We’re now building a Bitcoin savings app, letting users own their assets on-chain, simply and securely.”

Kamale, who is leading Onmeta’s upcoming Series A, compared the potential to Rapido’s early hyper-growth. “After Rapido’s Series A, they grew 30–40% month-on-month for months. We’ve now given Bharath the capital to do the same.”

Conviction before consensus

From bike taxis to battle royales to blockchain rails, the through-line of Skycatcher's portfolio is clear — conviction precedes consensus. Across its portfolio, they have consistently led from the front, leading Series A rounds in companies like Rapido and SuperGaming, and following on with deep conviction to help founders scale through each inflection point.

As Kamale summed up, "India’s entrepreneurs are no longer waiting for validation. They’re proving that when you focus on the next 500 million users — not just the first 10 million — you build companies the world can’t ignore."

In successive panel discussions at the event, Sia Kamalie, Founder & Managing Partner, Skycatcher; Aravind Sanka, Co-founder of Rapido; Saurav Jain, Principal at Prosus Ventures; Roby John, Co-founder & CEO of SuperGaming and Bharath T, Co-founder & CEO of Onmeta demonstrated the spirit of early conviction.

Riding ahead of the curve

Aravind Sanka’s journey with Rapido began far from the comfort zone of India’s metros. "We didn’t want to build for the top ten million; we wanted to build for the next five hundred million," he said. Originating from a Tier-IV town, Sanka recognised a gap few were addressing — affordability in daily mobility.

While competitors focused on premium city markets, Rapido built its thesis around smaller towns, making two-wheeler taxis affordable, insured and safe. Today, Rapido commands a market share of nearly 90 per cent in Tier-III and IV towns. "Two-wheeler taxis seem obvious now, but when we started, they weren’t," he reflected.

For investor Sia Kamalie, who led Rapido’s $4 million Series A, the contrarian bet was intuitive. Having previously invested in a Bangladeshi ride-sharing startup, Kamalie saw the same early-market signals. "These moments when you can be contrarian are very rare," he noted.

"We wanted someone with conviction, not curiosity." Skycatcher not only led the Series A but also followed on in later rounds, staying committed through Rapido’s scale journey and helping drive the company toward the next stage of growth.

Backing the builders, not the buzz

Sia Kamalie calls Skycatcher an “entrepreneur investor” rather than an institutional fund. “We’re truly all-in,” he said. “We’re not chasing credentials; we’re chasing greatness and we’re not afraid to make mistakes along the way.”

That philosophy has paid off. Skycatcher invested in Rapido when few believed two-wheelers could be regulated or trusted. Eight years later, it realised part of that investment, redeploying capital into the next wave of founders who, as Kamale puts it, could become the ‘Rapido Mafia’; lean, disciplined builders defining India’s cost-efficient innovation DNA.

From players to global publishers

One such bet is SuperGaming, a Pune-based studio proving that India can build global gaming IP. “We’ve built games like MaskGun and Silly Royale, played by over 200 million people across the globe,” said CEO Roby John.

Sia Kamalie, who led SuperGaming’s Series A and B rounds, saw a much bigger play. “Social gaming is a $200 billion market, far larger than real-money gaming,” he said. “If you get the social layer right, you build franchises that last decades.”

John shared that recent regulatory clarity separating real-money from video gaming is a turning point. “For years, we had to keep saying we make video games, not betting products. Now the government has drawn that line giving much-needed clarity to our space.”

What sets SuperGaming apart is their ability to build a game within the battle royale genre which typically requires $100 million in development costs — with just $15 million. This feat is made possible by the studio’s proprietary in-house tech stack that significantly cuts down on external dependency. More importantly, it’s powered by the relentless drive of its co-founders, who’ve been building together for over 15 years.

SuperGaming is also channeling India’s cultural power into a new IP. Partnering with FanCraze, it is set to launch ICC SuperTeam— a community-first social cricket app that celebrates fandom, not fantasy. “Cricket is a culture in India,” John said. “We’re reinventing how fans re-live their favourite moments without touching betting or speculation.”

Building the next financial rails

The conversation closed with Skycatcher’s newest investment — Onmeta, a bridge between the Indian rupee and the crypto economy. "We provide rails that let users access Web3 apps using INR," explained founder Bharath T.

Kamale described Onmeta as part of the same conviction-driven lineage. “Crypto can do what Rapido did for mobility — make it cheaper, faster, and more inclusive,” he said.

Bharath highlighted the regulatory progress since 2022 — taxation rules, FIU monitoring, and a coming national crypto policy. “India should empower users to safely access decentralized apps,” he said. “We’re now building a Bitcoin savings app, letting users own their assets on-chain, simply and securely.”

Kamale, who is leading Onmeta’s upcoming Series A, compared the potential to Rapido’s early hyper-growth. “After Rapido’s Series A, they grew 30–40% month-on-month for months. We’ve now given Bharath the capital to do the same.”

Conviction before consensus

From bike taxis to battle royales to blockchain rails, the through-line of Skycatcher's portfolio is clear — conviction precedes consensus. Across its portfolio, they have consistently led from the front, leading Series A rounds in companies like Rapido and SuperGaming, and following on with deep conviction to help founders scale through each inflection point.

As Kamale summed up, "India’s entrepreneurs are no longer waiting for validation. They’re proving that when you focus on the next 500 million users — not just the first 10 million — you build companies the world can’t ignore."

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_logo_headquarters_original_jpg_d9fbb245f9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rigetti_resized_jpg_4e393f1208.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_COMCAST_NBC_Universal_OG_jpg_6c6153d748.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)