Advertisement|Remove ads.

IndusInd Bank Surges On Nomura Upgrade: SEBI RA Manish Kushwaha Eyes Breakout Rally

IndusInd Bank shares rose 4.3% on Wednesday after Nomura upgraded the stock to ‘Buy’ with a target price of ₹1,050, implying a 30% upside.

According to Nomura’s note, legacy issues have been addressed, and return on assets (RoA) is expected to improve to 1% by FY27.

The brokerage also highlighted the bank’s positive governance commitment and the potential for RBI approval on promoter stake as key factors supporting its view.

SEBI-registered analyst Manish Kushwaha also recommended a ‘Buy’ on the stock, noting a key resistance zone in the ₹850–₹860 range.

He said that the stock is forming an ascending triangle pattern, typically a bullish continuation structure.

He added that a breakout above ₹855 with volume could trigger a strong upward move.

According to Kushwaha, the Relative Strength Index (RSI) at around 58.28 indicates neutral-to-positive sentiment, with headroom before entering the overbought zone.

He placed near-term targets at ₹960, ₹1,020, and ₹1,100, with a stop-loss at ₹750.

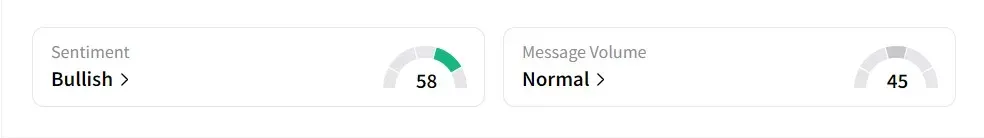

On Stocktwits, retail sentiment was ‘bullish’ amid ‘normal’ message volume.

The stock has declined 12.9% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)