Advertisement|Remove ads.

Infosys Delivers Steady Q1 But Fails To Lift Investor Sentiment; SEBI RA Flags Bearish Technical Signals

IT bellwether Infosys reported an 8% increase in net profit at ₹6,924 crore for Q1FY26. Revenue for the period rose 7.5% to ₹42,279 crore, supported by large deal wins worth $3.8 billion.

The company raised the lower end of its FY26 revenue guidance to 1-3%, indicating cautious confidence despite macroeconomic uncertainties. Margin guidance for the full year remains unchanged at 20 - 22%.

Deal wins were broad-based across multiple sectors and geographies, as the company remains focused on AI-led automation and cost-saving solutions.

Technical Outlook

While Infosys delivered a decent Q1FY26 performance, the technical charts suggest the stock isn't out of the woods yet.

Despite a brief bounce in May, the trend remains bearish with the stock and the Nifty IT index still trading below their 200-day exponential moving averages (EMA), according to SEBI-registered analyst Mayank Singh Chandel.

Infosys is currently moving sideways in a narrow range of ₹1,511 - ₹1,600, and unless it breaks above the 200-day EMA with volume, there’s limited scope for a sustained rally, Chandel said. A breakdown below ₹1,511 could trigger fresh selling pressure.

At the time of writing, Infosys shares were down 0.5% at ₹1,550.5.

The analyst recommends waiting for a breakout above the 200-day EMA before considering fresh positions. Until then, it's a range-bound play with a cautious bias.

SEBI-registered analysts Financial Independence believe that the focus will now shift to deal execution, margin recovery, and free cash flow, following the company’s cautious raise of its FY26 guidance.

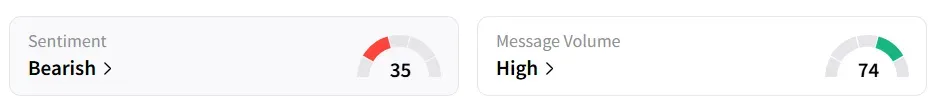

Retail sentiment on Stocktwits turned ‘bearish’, amid ‘high’ message volumes. It was ‘neutral’ ahead of the quarterly results.

Year-to-date, the stock has lost 17.6% in value.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_corsair_gaming_jpg_f2eebff8d4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2214866166_jpg_efcc3db1cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)