Advertisement|Remove ads.

Intel Stock Slips As China Mulls Antitrust Probe Amid US Tariff War, But AMD’s Struggles Keep Retail Confidence High

Intel Corp. (INTC) shares fell 1.3% as markets opened on Wednesday following a report from the Financial Times indicating that Chinese regulators are considering a formal investigation into the U.S. chipmaker.

This comes alongside renewed antitrust probes targeting Alphabet Inc.’s Google (GOOGL) and Nvidia Corp. (NVDA) as tensions rise in the ongoing U.S.-China tariff dispute.

Sources cited by the publication said the specifics of the Intel probe remain unclear, and its progression may hinge on the broader state of U.S.-China relations.

Chinese President Xi Jinping is expected to engage in talks with U.S. President Donald Trump in the coming days.

China's State Administration for Market Regulation confirmed on Tuesday that it has initiated a competition investigation into Google, which will reportedly focus on the dominance of the tech giant’s Android operating system and its potential impact on Chinese smartphone manufacturers such as Oppo and Xiaomi.

The antitrust investigation into Nvidia’s was announced in December, after the Biden administration further restricted China's access to the company’s high-end hardware.

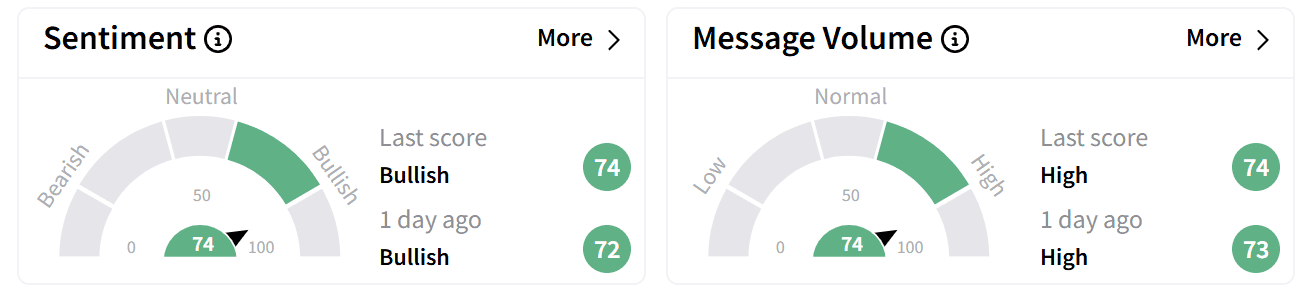

On Stocktwits, retail sentiment around Intel remained in ‘bullish’ territory accompanied by ‘high’ levels of chatter.

Many users had anticipated that Intel’s stock would move higher, given rival AMD’s stock is on track to hit two-year lows after it reported upbeat fourth-quarter earnings but disappointed Wall Street with slower growth in its PC and data center segments.

Intel's stock has declined nearly 50% over the past year, with losses exceeding 5% year-to-date in 2025.

The shares fell close to 3% on Jan. 31 after Intel issued a weaker-than-expected revenue forecast for the first quarter of 2025.

Both AMD and Intel have faced bearish analyst calls post-earnings, with concerns centered on PC inventory build-up.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)