Advertisement|Remove ads.

Intel Reportedly Dodges Shareholder Lawsuit, But Stock Continues Slide As Trump Moves To Kill Chips Act – Retail’s Divided

Intel (INTC) reportedly won the dismissal of a shareholder lawsuit that accused the company of concealing problems in its foundry business, which led to massive job cuts and a dividend suspension that wiped out more than $32 billion in market value in a single day.

The lawsuit claimed Intel artificially inflated its stock price from Jan. 25 to Aug. 1, 2024. The rally ended when the chipmaker posted a $1.61 billion quarterly loss, announced layoffs affecting more than 15,000 employees, and suspended its dividend to save $10 billion by 2025.

Shares fell 26% the following day, erasing tens of billions in market capitalization.

According to a report by Reuters, the court rejected claims that Intel delayed disclosure, noting that the company only reported the loss in April when it changed its financial reporting structure.

It found that shareholders had incorrectly attributed the $7 billion loss to the Intel Foundry Services unit and were not deceived into thinking that the segment’s reported earnings covered the entire Intel Foundry Model.

The ruling also cleared former CEO Patrick Gelsinger, who had described Intel’s foundry offering as gaining "significant traction" and seeing "growing demand."

The judge concluded those statements were not misleading, as they referred to specific customers rather than overall revenue, which was declining.

Intel shares extended their two-day slide on Wednesday, losing nearly 5% in afternoon trading after former President Donald Trump called for the repeal of the Chips Act during a joint session of Congress.

The company has been the biggest beneficiary of the semiconductor subsidy program, securing a $7.9 billion grant to build new fabrication plants nationwide.

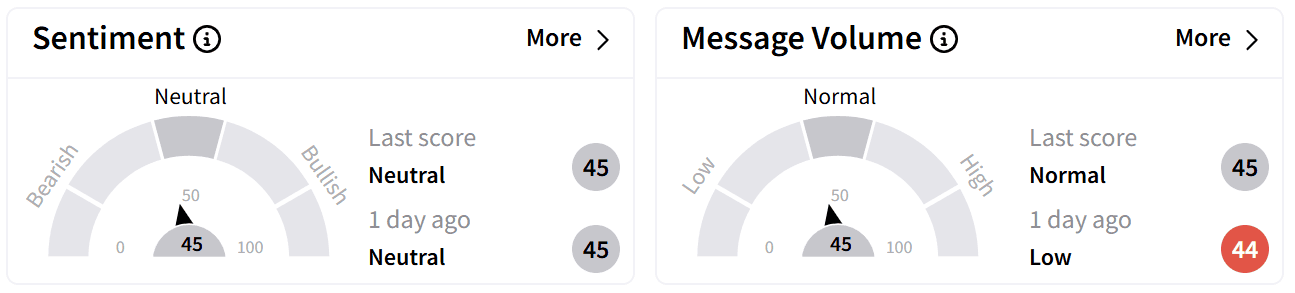

Retail sentiment on Stocktwits around Intel’s stock remained in the ‘neutral’ zone, even as chatter saw a marginal uptick.

One user pointed out that while Intel remains strategically crucial for national security, its financial position remains weak.

Another speculated that Trump’s opposition to the CHIPS Act was more about redirecting subsidies toward U.S.-based chipmakers rather than eliminating them entirely.

The stock has lost over half its value over the past year and remains flat year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)