Advertisement. Remove ads.

Intellia Stock Plunges To 4-Year Low Despite Promising Mid-Stage Study Results For Rare Genetic Disorder Therapy, Retail Sentiment Dips

Intellia Therapeutics, Inc. ($NTLA) shares plunged hard on Thursday after the small-cap, clinical-stage biotech reported results from mid-stage study results of its CRISPR-based gene-editing therapy codenamed NTLA-2002 in patients with hereditary angioedema (HAE).

HAE is a rare genetic disorder that manifests as severe, recurring and unpredictable inflammatory attacks in various organs and tissues of the body. The condition could lead to potentially life-threatening swelling attacks.

The disorder has no curative therapies but current preventive therapies have to be administered lifelong.

Intellia said the results from the Phase 2 study showed NTLA-2002 has the potential to eliminate HAE attacks following a one-time infusion.

Among the findings from the study are:

- Both dose levels tested (25 mg and 50 mg) reduced mean monthly attacks, with the latter dose resulting in a 77% reduction during weeks 1-16 and 81% reduction in weeks 5-16.

- Eight of the 11 patients in the 50 mg arm were completely attack free following one-time infusion

- Safety and tolerability profiles were encouraging.

“We are highly encouraged by these results, which we believe sets NTLA-2002 apart from other prophylaxis treatments. What was previously an unimaginable potential to be free of chronic therapy is one step closer to becoming a reality for the HAE community,” said John Leonard, CEO of Intellia.

The company said it has selected the 50 mg formulation for evaluation in the global Phase 3 study dubbed ‘HALEO.’ Screening for the study is currently ongoing, it said.

HAE therapeutics market was at $4.1 billion in 2023 and is estimated to grow at 9.2% compounded annual growth rate between 2024 and 2032, according to Global Market Insights.

The negative reaction could be due to the “buy-the-rumor, sell-the-news” phenomenon as the stock tacked on about 17% gains from a near-term (Oct. 10) low of $17.09.

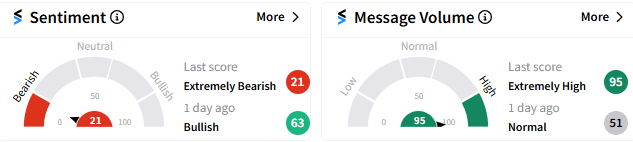

On Stocktwits, retail trader sentiment was ‘extremely bearish’ (21/100), reversing from ‘bullish’ mood a day ago, with message volume spiking to ‘extremely high.’

At 11:05 am ET, the stock was down 19.51% at $16.05, although off the day’s low of $15.52, which marked the lowest level in over four years.

Read Next: UPS Stock Soars Pre-Market, Keeps Retail Bullish As Q3 Beat Pleases Wall Street

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_hasbro_OG_jpg_4dd074e151.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_worldcoin_orb_OG_jpg_6c9401c649.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_OG_jpg_33767c6232.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233715487_jpg_d8c0f3abb7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elon_musk_jpg_80fa2e9cda.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231040292_jpg_098a089ec8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)