Advertisement|Remove ads.

IonQ Announces Mixed Q4 Results, $500M At-the-Market Stock Offering - Stock Slips But Retail Support Stays Strong

IonQ, Inc. (IONQ) shares were in reverse gear in Thursday’s premarket session after the company reported its financial results for the fiscal year 2024 fourth quarter and announced a common stock offering.

The College Park, Maryland-based company also confirmed that it has agreed to acquire a controlling stake in Geneva, Switzerland-based quantum-safe crypto solutions provider ID Quantique in an all-stock transaction.

Alongside the deal, IonQ also announced a strategic partnership with South Korean telecom operator SK Telecom.

The deal is expected to close in the next nine months.

IonQ Executive Chair Peter Chapman said the SK Telecom partnership will enhance the distribution of IonQ quantum technology, leading to many commercial and technical opportunities.

Q4 Earnings

IonQ reported a loss per share of $0.93 for the fourth quarter, wider than the year-ago loss of $0.20. Revenue climbed nearly 92% year over year (YoY) to $11.71 million compared to the guidance range of $7.1 million to $11.1 million. The Finchat-compiled consensus estimate was $10.28 million.

The company reported a fourth-quarter adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) loss of $32.8 million, wider than the year-ago loss of $19.98 million.

New bookings totaled $22.7 million for the fourth quarter and $95.6 million for the full year, exceeding the guidance of $75 million to $95 million.

IonQ ended the quarter with a cash position of $363.8 million.

Commenting on the results, Chapman said, “We had IonQ’s best year yet in 2024, exceeding the high ends of both our bookings and revenue guidance ranges and making truly significant technical strides.”

He noted that the company has a strong pipeline for 2025.

Forward Guidance

IonQ expects first-quarter revenue of $7 million to $8 million, trailing the $16.25-million consensus estimate, and fiscal year 2025 revenue of $75 million to $95 million, aligning with the consensus estimate of $83.18 million.

The company guided adjusted EBITDA to a loss of $120 million.

Common Stock Offering

IonQ said it has entered into an agreement with Morgan Stanley and Needham, allowing it to sell up to $500 million worth of its common stock at an “at-the-market equity offering.

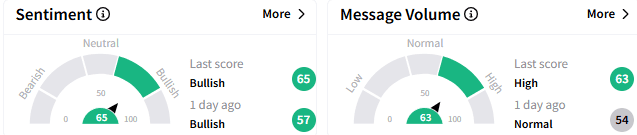

On Stocktwits, the sentiment toward IonQ stock remained ‘bullish’ (57/100), and the message volume improved to a ‘high’ level.

IonQ was among the top ten trending tickers on the platform.

A bullish watcher said the initial stock reaction to earnings may have been overdone, adding that the company is now well positioned.

Another user said IonQ’s near-term catalysts include Defense Advanced Research Projects Agency (DARPA) funding and Nvidia’s Quantum Day scheduled for March 20.

In premarket trading, IonQ stock fell 4.91% to $28.46. It has lost over 28% this year after it soared over 150% in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: C3.ai Stock Slides Despite Q3 Beat But Retail Sentiment Turns Markedly Upbeat

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)