Advertisement|Remove ads.

IonQ Halts ATM Program After $372M Fund Raise, Stock Rebounds Pre-Market; Retail Doesn't Budge

IonQ, Inc. (IONQ) stock rose in Tuesday’s premarket session, following its 11% drop in the previous session amid the broader market slump.

College Park, Maryland-based IonQ, a manufacturer of high-performance quantum computers, said late Monday that it has sold 16.04 million shares under its at-the-market (ATM) equity offering.

The aggregate proceeds from the offering were about $372.60 million, with the net proceeds at about $360 million. The ATM offering announced in late February envisaged raising $500 million.

IonQ said it has terminated the ATM program as it has raised sufficient funds to meet its currently anticipated capital needs. It also cited the recent market disruption, the stock’s weakness, and the overhang from having an ATM program in effect as reasons for its decision.

CEO Niccolo De Masi noted that with the offering, the company’s cash balance stands at $700 million on a pro forma basis. “We are confident that we now have the capital we need for continued global leadership in both our quantum computing and quantum networking divisions,” he added.

IonQ also clarified that during the company’s current trading window through March 15, none of its executive officers or directors, except Executive Chair Peter Chapman, intend to sell shares.

Chapman previously disclosed his intention to exercise options for up to 2 million shares for a real estate purchase and tax payment.

Separately, IonQ said it owns or controls nearly 400 granted and pending patents worldwide. The company noted that its controlling stake in ID Quantique expanded its patents by 250.

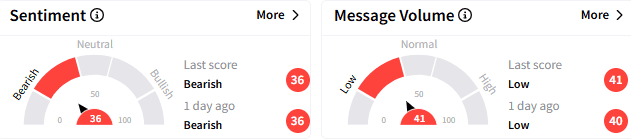

On Stocktwits, retail sentiment toward IonQ remained ‘bearish’ (36/100), and the message volume remained ‘low.’

The stock has lost more than 56% so far this year.

A bearish watcher said there is still “plenty of room” for more downside,

Another user said IonQ could only survive through an M&A transaction.

In premarket trading, IonQ stock rose about a percent to $18.45.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Oracle's Q3 Results, Guidance Disappoint - Retail Shrugs Off Dividend Hike, Rosy 2026 Outlook

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1248428688_jpg_059f14eab1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Palo_Alto_logo_1200pi_resized_jpg_eee56769fa.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_crash_490d43331a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_88435a6487.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)