Advertisement|Remove ads.

Oracle's Q3 Results, Guidance Disappoint - Retail Shrugs Off Dividend Hike, Rosy 2026 Outlook

Oracle Corp. (ORCL) stock slipped in Tuesday’s premarket session after the cloud and database giant reported a double miss for the third quarter and issued lackluster guidance for the current quarter. However, the company drummed up its sales backlog and flagged 15% revenue growth for the fiscal year 2026.

Austin, Texas-based Oracle reported adjusted earnings per share (EPS) of $1.47 for the third quarter of fiscal year 2025, up from the year-ago quarter’s $1.41. The result trailed the Finchat-compiled consensus of $1.49 and the company’s guidance of $1.50-$1.54.

Revenue rose 6% year over year to $14.1 billion, compared to the $14.39 billion consensus estimate and the company's 7-9% growth forecast.

Oracle noted that cloud services and license support revenue grew 10% year-over-year (YoY) to $11 billion but cloud license and on-premise license revenue fell 10% to $1.1 billion.

Cloud revenue rose 23% to $6.2 billion, Cloud infrastructure revenue jumped 49% to $2.7 billion, and Cloud application revenue increased 9% to $3.6 billion.

The remaining performance obligations (RPO) climbed 62% to $130 billion, higher than the 49% growth seen in the third quarter. Short-term deferred revenue was $9 billion, down from $9.4 billion in the second quarter.

Oracle CEO Safra Katz said, “Oracle signed sales contracts for more than $48 billion in Q3.” She noted that the company has signed cloud agreements with companies such as OpenAI, Meta Platforms, Inc. (META), Nvidia Corp. (NVDA), and Advanced Micro Devices, Inc. (AMD).

Chairman Larry Ellison said Oracle is on track to double its data center capacity this calendar year.

The company’s multi-cloud revenue from Microsoft Corp. (MSFT), Alphabet, Inc. (GOOGL) (GOOG), and Amazon, Inc. (AMZN) rose 92% in the last three months.

Oracle said its board declared a quarterly cash dividend of $0.50 per stock, a 25% increase from the current rate. The increased dividend will be paid on April 23 to shareholders of record as of the close of the business on April 10.

Katz said the company expects its $130 billion sales backlog to help drive 15% revenue growth in the next fiscal year, beginning June. The company also expects RPO to continue to grow rapidly as it looks forward to signing its first Stargate contract.

President Donald Trump announced in late January that the Stargate AI joint venture will be led by OpenAI and Japanese investment company SoftBank. Oracle is one of the alliance's key technology partners.

On the earnings call, Katz said fourth-quarter revenue growth will likely be 8%-10%, with the total Cloud revenue growth estimated at 25%-27%, according to the transcript made available by Koyfin. The company guided non-GAAP EPS to $1.61 to $1.65.

Analysts, on average, estimate non-GAAP EPS of $1.64 and revenue growth of 9.07%.

The CEO clarified that the earnings guidance is negatively impacted by $0.03 due to losses recognized from an investment in another company.

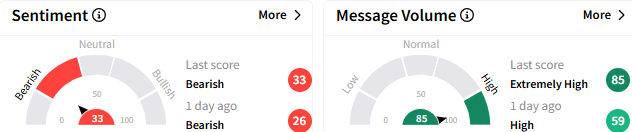

On Stocktwits, retail sentiment toward Oracle stock remained ‘bullish’ (34/100), but the earnings report sent retail chatter to ‘extremely high’ levels.

A bearish watcher said it was unusual for the company to give full-year guidance along with the third-quarter report. They saw it as an effort to stem the stock slide stemming from a weak quarterly print.

Another user said the stock is a good short and will likely fall to the $143 level.

In premarket trading, Oracle stock fell 0.53% to $148. The stock is down 10.5% year-to-date.

For updates and corrections email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2214866166_jpg_efcc3db1cd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_jpg_24a16f95b0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)