Advertisement|Remove ads.

IRB Infrastructure Seen As Attractive Buy At ₹41–₹39 Demand Zone: SEBI RA Prameela Balakkala

IRB Infrastructure offers a compelling buying opportunity if the stock price dips into the ₹41–₹39 demand zone, which is identified as an ideal accumulation level for investors, according to SEBI-registered analyst Prameela Balakkala.

The firm showed strong operational results as its toll collection increased by 23% compared to the previous year and exceeded India's national toll growth average of 12.5%, demonstrating “strong” asset productivity.

At the time of writing, IRB Infrastructure's shares were trading at ₹50.51, down 0.32% or ₹0.16.

The company recorded top-line growth, but its EBITDA performance deteriorated by 20% year-over-year, reaching ₹1,066.5 crore, which shows margin pressures that need investor attention, Balakkala said.

The technical resistance level between ₹52 and ₹53 is significant as heavy call option writing has capped the stock's short-term upward potential.

The analyst said that the 200-day simple moving average presents additional resistance since it remains above the market price and obstructs upward movement.

Balakkala reveals that the company's net debt-to-equity ratio is 0.59x, which indicates the need for continuous monitoring of debt levels.

The analyst suggests investors exercise caution with IRB Infrastructure on the back of technical resistance and margin pressures despite its solid fundamentals

She recommends waiting for a price pullback to the demand zone before buying.

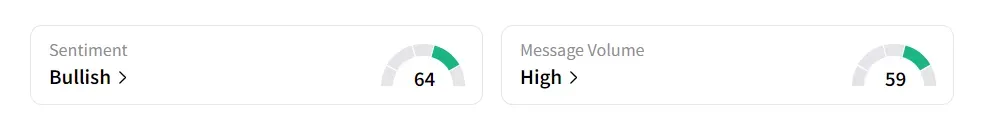

On Stocktwits, retail sentiment was ‘bullish’ amid ‘high’ message volume.

The stock has declined 15.2% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)